The governor is talking about restructuring general obligations, a change from his earlier stance to protect Puerto Rico’s direct debt, said Gary Pollack, who manages $6 billion of munis as head of fixed-income trading at Deutsche Bank AG’s Private Wealth Management unit in New York. In May, the governor said in his annual speech to the legislature that defaulting on the commonwealth’s bonds would be a mistake. He called it “folly” at the time.

In an interview with the New York Times, Garcia Padilla “referenced all Puerto Rico debt and that’s a scary thing,” Pollack said.

With two days left in Puerto Rico’s fiscal year, the commonwealth is struggling to pass a budget that would allow it to make payments on a $72 billion debt load. Investors should work with the commonwealth to reduce its obligations, Garcia Padilla told the Times.

“The debt is not payable,” the governor said. “There is no other option.”

Swap Call

A report commissioned by the island and released Monday suggests that Puerto Rico swap current debt to delay maturities.

The U.S. territory of 3.5 million people is grappling with a jobless rate double the national average and a debt load bigger than every U.S. state except California and New York. The governor’s remarks land in a jittery global debt market, as investors weigh the possibility of a Greek default and exit from the euro zone.

The governor and his chief of staff were unable to comment, Jesus Manuel Ortiz, a spokesman in San Juan for Garcia Padilla, said in a text message. Betsy Nazario at the Government Development Bank, which handles the island’s debt transactions and lends to the commonwealth and its agencies, didn’t respond to an e-mail, text and phone message.

The governor plans a televised address at 5 p.m. local time after meeting with lawmakers.

The territory’s House of Representatives and Senate last week passed differing budget bills for the fiscal year starting July 1, with negotiations between the two chambers continuing. Under the proposals, about 15 percent of the $9.8 billion budget would go to debt service. Both plans cut spending by more than $600 million.

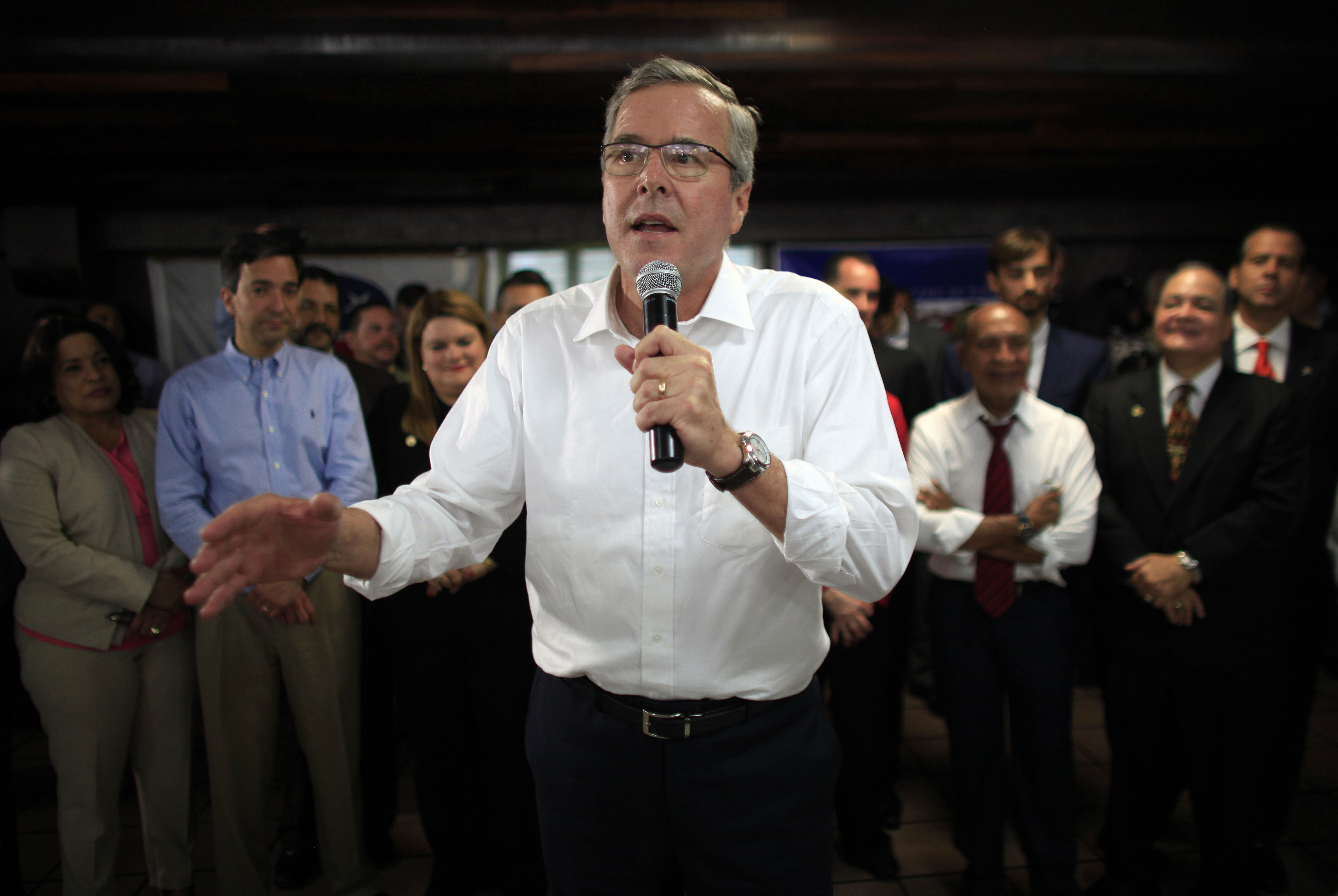

© AP Photo/Ricardo Arduengo, File FILE- In this April 30, 2015, file photo, Puerto Rico Gov. Alejandro Garcia Padilla delivers his budget address for the next fiscal year at the Capitol building in San Juan. Puerto Rico's governor believes the U.S…

© AP Photo/Ricardo Arduengo, File FILE- In this April 30, 2015, file photo, Puerto Rico Gov. Alejandro Garcia Padilla delivers his budget address for the next fiscal year at the Capitol building in San Juan. Puerto Rico's governor believes the U.S…Crunch Times

The governor “ran out of options,” said Robert Donahue, managing director at Municipal Market Analytics Inc., a Concord, Massachusetts-based research firm. “Further borrowing would have only compounded unsustainable debt and worsened economic deterioration.”

Bond insurers, including Assured Guaranty Ltd. and MBIA Inc., insure about $14 billion of Puerto Rico debt. Shares of Assured fell about 13.4 percent Monday to $23.76 in New York. MBIA traded at $6.37, down 23.5 percent.

Puerto Rico’s cash crunch is intensifying. The GDB had $778 million of net liquidity as of May 31, down from $2 billion in October. Officials last week were considering offering to exchange GDB bonds due in the next three years for new debt with longer maturities, according to a person with direct knowledge of the discussions.

No Precedent

A group of former International Monetary Fund officials, in the report released Monday, recommend that approach across Puerto Rico debt.

Puerto Rico should voluntarily exchange old bonds for new ones with later maturities and lower debt payments, Anne O. Krueger, Ranjit Teja and Andrew Wolfe wrote in the report, which is dated June 29.

“There is no U.S. precedent for anything of this scale and scope, and there is the added complication of extensive pledging of specific revenue streams to specific debts,” they wrote. “But difficult or not, the projections are clear that the issue can no longer be avoided.”

The U.S. Congress should allow Puerto Rico entities to file for Chapter 9 bankruptcy protection, and an independent oversight board could help improve the island’s finances, the authors wrote.

The White House also is urging Congress to examine whether to make Puerto Rico entities eligible for Chapter 9, White House press secretary Josh Earnest said in a briefing Monday.

Puerto Rico may confront budget deficits reaching $3.5 billion when factoring in rising health-care costs and the loss of the island’s excise tax in 2017 unless lawmakers continue the levy, the economists wrote in their report.

No Bailout

The Obama administration isn’t contemplating any bailout for Puerto Rico and has instead been working with a task force of federal experts to identify aid under existing programs, the White House’s Earnest said.

As lawmakers debate the budget for the fiscal year beginning July 1, the island’s main electricity provider is also hitting a wall. The utility, known as Prepa, has a July 1 bond payment that it may not make, and is negotiating with creditors over restructuring $9 billion of debt. Creditors say the power provider has the money for the payment.

Hedge funds and distressed-debt buyers have been purchasing Puerto Rico securities as traditional muni holders reduce holdings. About half of U.S. muni mutual funds hold debt from Puerto Rico, down from 77 percent in October 2013, according to Morningstar Inc. The island’s securities are tax-exempt nationwide.

--With assistance from Justin Sink in Washington.

To contact the reporters on this story: Bill Faries in Miami at wfaries@bloomberg.net; Michelle Kaske in New York at mkaske@bloomberg.net To contact the editors responsible for this story: Shannon D. Harrington at sharrington6@bloomberg.net Mark Tannenbaum, William Selway

Prices on Puerto Rico’s newest general obligations sank to record lows after Governor Alejandro Garcia Padilla said investors should be prepared to sacrifice if they want the cash-strapped island’s economy to grow.

Puerto Rico Governor Calls Debt Unpayable as Deadlines Loom