Prudo Jimenez was born on a sugar farm here in 1941, when agriculture ruled Puerto Rico’s economy. He grew up to be a supervisor for drug maker Syntex in the 1960s, after U.S. manufacturers came in droves, seeking a tax haven.

The peppy 75-year-old personifies an economic development movement designed to transform a generation from poor farmers to industry leaders.

Yet when Jimenez started his own venture, a horse breeding operation, he couldn't make it work. His sons fared no better. Carlos Jimenez, 48, and Anjoe, 50, each started businesses only to see them go under in a decade-long economic slump that continues today.

The experience of the Jimenez family highlights the U.S. territory's failure over decades to nurture a sustainable economy, one anchored by local entrepreneurs, even as the island modernized and standards of living rose.

“We didn’t have the foresight of developing local industry,” Prudo Jimenez said. “We depended always on people from the outside.”

The island’s historic dependence on mainland corporations – and the tax breaks needed to retain them – underpins its latest economic meltdown and its descent into the largest municipal debt crisis in U.S. history.

The strategy calcified over decades into political and cultural norms. Longstanding economic policies tend to favor outside corporations over local upstarts, and island universities are just now learning to teach business students how to start ventures after decades of training them for middle management.

A dysfunctional local bureaucracy further undermines business formation. Dozens of interviews with business owners, advocates, officials and economists, reveal a government that holds up routine permits and payments to government contractors for months or years.

One education consultant said he lost a $12 million government contract due to payment delays; another entrepreneur scrapped plans for an assisted living facility because of a five-year wait for permits; food truck operators are required mountains of government forms to work a single festival.

The Jimenez family can relate. Carlos spent nearly two decades building a car wash chain until recession doomed the business this year. Older brother Anjoe owned two agricultural supply stores before he shut down in 2010 and moved to Georgia, a bust he attributes to high taxes and competition from Wal-Mart Inc. Prudo started a thoroughbred business on the farm he inherited from his parents, in rural Arecibo. But he gave it up in 2000, at the earliest signs of the economic downturn, and lost about $200,000.

Now facing an even tougher economic reckoning, Puerto Ricans are starting to seek ways to fend for themselves, and an entrepreneurial spirit is taking hold. But startups still face steep obstacles.

“The embryo of the new Puerto Rico is growing robustly,” said Jon Borschow, founder of the nonprofit Foundation for Puerto Rico, which focuses on building the island’s lagging tourism industry. “It’s just not visible, because it hasn’t broken through the shell of the old Puerto Rico.”

ECONOMY OF DEPENDENCE

Puerto Rico’s economic malaise has roots in an industrialization movement dating to the late 1940s, as the island tried to emerge from its colonial past and achieve greater economic freedom. In some ways it accomplished the opposite: In trying to be attractive to U.S. firms, Puerto Rico instead became indentured to them, pledging tax breaks and cheap labor for ultimately transient economic benefits.

The industrialization push, dubbed Operation Bootstrap, rested on the premise that manufacturers lured by tax breaks would spur the development of a local economy because they would need local suppliers. The federal government supported the effort, viewing Puerto Rico as a vital capitalist outpost in the Caribbean.

Standards of living rose under Operation Bootstrap, but the long-term impact is fraught with contradictions. It led to better jobs and a more educated populace, but did little to expand the workforce. It turned out that the manufacturers were generally locked into global supply chains, and so they had limited impact on local business creation.

Between 1950 and 1980, per capita gross national product grew tenfold in Puerto Rico, and disposable income shot up 1,600 percent, according to the Puerto Rico Planning Board. Yet during the same period, unemployment rose and labor participation rates fell. Most notably, legions of Puerto Ricans moved away, with 600,000 more people leaving than arriving between 1950 and 1970.

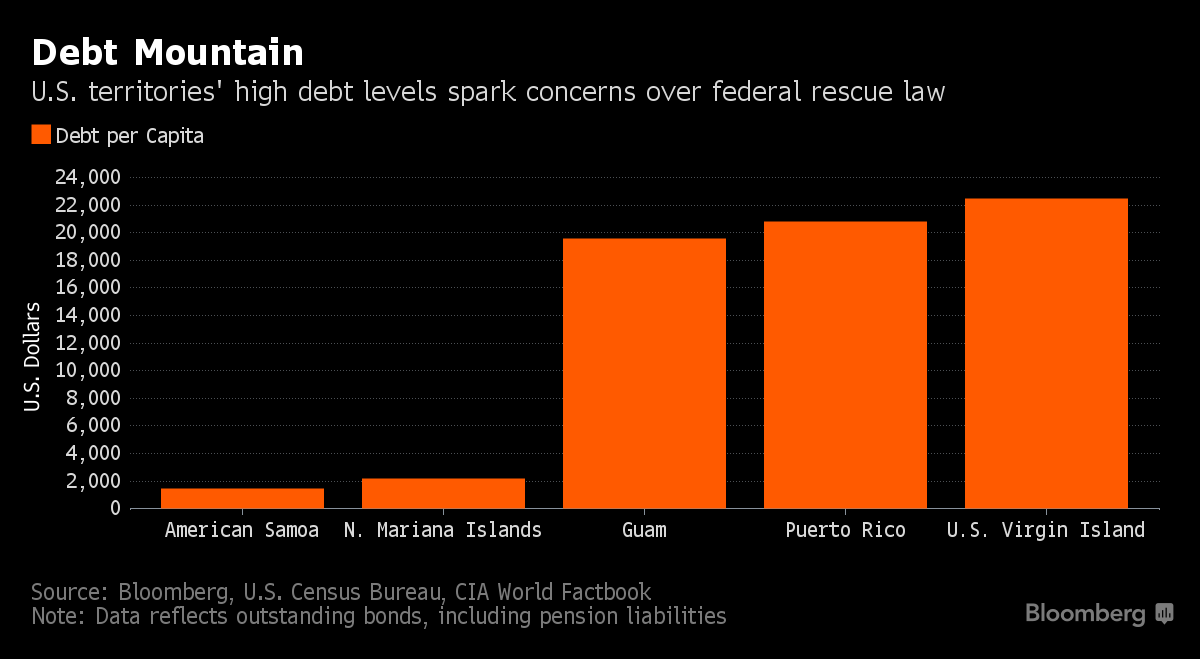

Today, the U.S. territory has nearly $70 billion in debt, an unemployment rate 2.5 times the U.S. average, a 45 percent poverty rate, nearly insolvent pension systems and a chronically underfunded Medicaid insurance program for the poor.

The economic nosedive started in 2006, at the end of a 10-year phase-out by U.S. congress of tax breaks that had brought manufacturers to the island. Plant closures and job losses followed. Puerto Rico’s commonwealth government made things worse by taking on years of debt to replace the lost revenue.

Proposed fixes aim to restructure that debt and replenish the investment. Some industry leaders in Puerto Rico are lobbying the U.S. Congress for economic incentive proposals that echo the industrialization push of the past.

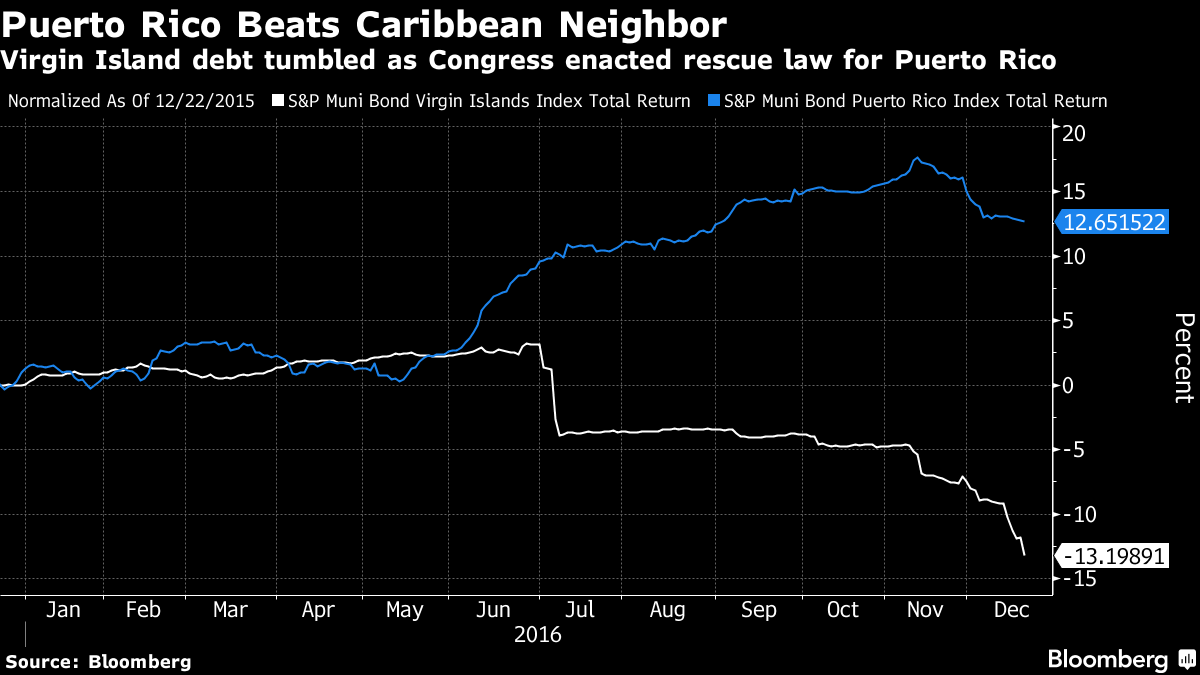

A plan being considered by the Joint Committee on Taxation, called 245A, would provide tax breaks aimed at drawing multinational firms. The future of the incentive proposal is in doubt, however, after lawmakers declined to include it in the Puerto Rico rescue law known as PROMESA, passed earlier this year.

Some Puerto Ricans fear that more tax break schemes will only promote the same artificial stability that preceded the latest economic crash. The island needs to evolve from “a culture of employees to a culture of entrepreneurs,” said Antonio Medina, who stepped down in August as the chief of Puerto Rico's economic development agency, known as PRIDCO.

Francisco Garcia – executive vice president of the Puerto Rico Manufacturers’ Association, which supports 245A – argued the island’s ailing economy nonetheless needs an immediate jolt of outside investment.

“We have to develop an entrepreneurial ecosystem, but that takes time, and in the meantime, we need tax incentives,” he said.

Only 2.3 percent of the island’s workforce was self-employed by an incorporated business in 2015, lower than all but two U.S. states, according to U.S. Census data. Puerto Rico had one physical establishment per 80 people in 2014, only half the U.S. average, suggesting an economy with fewer but larger employers.

One reason: Puerto Rican entrepreneurs are fleeing to the mainland. Between 2007 and 2012, the number of Puerto Rican-owned businesses in the 50 states shot up by 65 percent, the biggest spike among Latin American or Hispanic groups, U.S. Census data shows.

One of the island’s entrepreneurial standouts is Javier Soltero, a 42-year-old San Juan native who founded the software startup Hyperic with four friends in 2004, then sold it five years later to Palo Alto, California-based VMWare, for $420 million. Five years after that, Soltero sold his next venture, the mobile mail app Acompli, to Microsoft for $200 million.

Trouble is, Soltero founded these companies in Silicon Valley, where he lives and works as a Microsoft executive, not in Puerto Rico.

“It’s not impossible, but hard” to build a tech business in Puerto Rico, Soltero said, without the talent and the entrepreneurial mindset that surround him in Silicon Valley.

The Valley, to be sure, attracts entrepreneurs from everywhere, not just Puerto Rico. But the island’s history as an outpost for U.S. corporations also shaped cultural aspirations and higher education in a way that many say discouraged entrepreneurship.

The University of Puerto Rico, with 11 campuses and some 70,000 students, has produced some of Puerto Rico’s most influential minds, including four of its ex-governors. UPR’s engineering school, especially, has a strong reputation. But Yvette Collazo, director of the U.S. Small Business Administration’s Puerto Rico branch, recalled that during her years as a UPR student in the early 1990s, “nobody ever talked to me about opening my own business.”

Teachers and students looked to others for opportunity, Collazo said in an interview.

“It was everyone’s goal to go work for NASA, or for renowned agencies or companies,” she said. “Professors encouraged it.”

Jose Vega, an associate professor of entrepreneurship and director of the business and economic development center at UPR’s Mayaguez campus, says the school has come a long way. He concedes that entrepreneurship “was not discussed” when he helped start the center in 1986. Now, the school offers an entrepreneurship minor gives students a space to collaborate on business ideas, Vega said.

But the school must do more, faster, especially in commercializing intellectual property created on its campuses, said Laura Cantero, executive director of Grupo Guayacan, a nonprofit organization that educates and provides financing to entrepreneurs.

PILES OF PAPERWORK

When Puerto Ricans do manage to launch businesses, the commonwealth’s government doesn’t provide much help in sustaining them and sometimes holds them back, business owners say.

Manuel Figueroa can attest to the difficulty in navigating the local bureaucracy. His educational services firm, Vernet, scored a three-year, $12 million contract in 2014 with Puerto Rico’s Department of Education to provide tutoring and coaching.

Figueroa got a loan from Banco Popular to fund operations until the government paid him. When a year passed with no payment, Banco Popular pulled the financing – forcing Figueroa to walk away from the project and fire about 75 of 100 employees.

Banco Popular declined to comment on its dealings with Vernet.

The education department’s problems were technological, Figueroa said. It got backed up with thousands of invoices that had been converted to PDF documents and scanned into an electronic filing system – basically, a virtual file cabinet. Vernet alone submitted about 90,000 pages to support invoices.

“What the department considered ‘use of technology’ was basically doing it by hand,” Figueroa said in an interview at his Caguas, Puerto Rico office. “It has to be an individual that goes through those 90,000 pages.”

The Puerto Rico Department of Education did not respond to several requests for comment.

Getting business permits can be just as onerous. Figueroa’s list of permits and certificates is 20 items long, including at least five certificates of tax compliance. He needs documents proving compliance with child support laws, which he has to re-file every month.

Puerto Rican entrepreneur Justin Velez-Hagan dumped plans to start an assisted-living franchise in 2007 when he learned it could take up to five years to begin construction. Velez-Hagan said he needed certification from the island’s department of health, approval from taxing authorities, a green light from a town planning board, construction permits and certain legal variances – steps he said had to be taken sequentially, and could take around a year each, or more.

The island’s permitting agency did not respond to multiple requests for comment. Governor Alejandro Garcia Padilla’s office declined to comment on permitting issues.

Velez-Hagan recently started Unfoiled.co, a tech industry talent acquisition firm, in Virginia, where he now lives. He incorporated the business online “instantaneously,” he said.

Maria Jose Delgado runs an ice cream truck she calls Cool Hope. She has to submit 23 documents for a one-year operating permit in San Juan, the 30-year-old said during an interview in a food truck park in the city’s Miramar section. Food truck owners who depend on festivals rather than full-time locations must submit the same 23 documents for every event they work.

“How can it be,” said food truck owner Yareli Manning, “that, to run a business for a year, they request the same paperwork as to operate for eight hours at a festival?”

A spokeswoman for the city of San Juan did not respond to requests for comment.

While government inefficiency stifles business formation, economic policies continue to tilt toward coaxing outside investment, with questionable results in expanding the economy and creating jobs.

Puerto Rico’s Act 22, passed in 2012, offers tax breaks to individuals who move to Puerto Rico, in hopes of drawing wealthy job creators. One longstanding Puerto Rico law provides breaks on local taxes for on-island manufacturing, while another does the same for exported services like call centers or software design.

Microsoft Corp has reaped huge tax savings through its Puerto Rico manufacturing subsidiary while creating relatively few jobs. The subsidiary reported $4 billion in profits in 2011 but paid only about 1 percent of that to Puerto Rico’s government and nothing to the U.S. government, according to a 2012 probe into corporate off-shore tax practices by the U.S. Senate Permanent Subcommittee on Investigations.

The Puerto Rico subsidiary employed just 177 people with an average salary of $44,000, but retained an outsized share of Microsoft’s U.S. earnings because Microsoft found ways to shift profits generated elsewhere to Puerto Rico, the subcommittee reported.

Microsoft did not respond to repeated requests for comment.

Most of Puerto Rico’s tax incentives can be used by local companies, said Juan Carlos Suarez, the island’s deputy secretary of economic development. But he acknowledged many were designed to entice outside firms.

“We’ve tried to do a lot in terms of marketing these laws to the local community,” Suarez said.

Local startups can’t take advantage of most incentives, however, because they require ongoing taxable revenue. “My target audience,” said Medina, the ex-PRIDCO chief, “was companies that were already running and making money.”

ECHOES OF A PAST CRISIS

Salvador Casellas, former Puerto Rico treasury secretary, remembers the economic urgency of the early 1970s like it was yesterday — and it bears striking resemblance to the island’s troubles today.

Then, like now, Puerto Rico lost access to bond markets during a global recession, and tried to reassure Wall Street through local tax hikes. Then, like now, it didn’t work, and the island turned to Congress for a help.

Casellas flew to Washington in 1974 to testify before a Congressional committee about the need for federal assistance. The result was a new set of tax breaks, known as Section 936, to replace similar incentives that had been repealed as the crisis took hold. Passed in 1976, the incentives allowed Puerto Rican subsidiaries to forgo federal taxes on earnings sent back to their U.S. parent companies, while paying Puerto Rico a small “tollgate tax” on the money.

But by 1993, lawmakers were growing wary of the giveaways to corporations. Arkansas Senator David Pryor had called Section 936 “the mother of all tax shelters,” and Congress decided to scrap it through a 10-year phase-out beginning in 1996.

The incentives had attracted mainly capital-intensive manufacturers, particularly pharmaceutical companies. Consumer goods giant Procter & Gamble Co and drug makers Pfizer Inc and Teva Pharmaceutical Industries Ltd were among the many companies that closed Puerto Rican plants in the years after the repeal of 936.

P&G spokesman Jeff LeRoy said the company sold one Puerto Rico plant in 2009, and has closed a second one this year as part of a strategy to “improve service … and to reduce costs.” LeRoy declined to comment on taxes.

Teva attributed the 2006 closure of its plant in Cidra, Puerto Rico, to a global “rationalization strategy” and a plan to “improve efficiencies,” according to a statement at the time.

Pfizer declined to comment.

Since the phase-out began, the island has lost 100,000 manufacturing jobs, and some economists triple the figure when accounting for indirect jobs.

The massive loss of employment and local income had ripple effects that caused local entrepreneurs, including the Jimenezes, to lose their businesses.

Now 81 and a federal judge, Casellas defends 936, although he concedes Puerto Rico’s economy became dependent on it.

“We wanted to create jobs,” he said in an interview in his San Juan chambers, “because jobs meant dignity for our people.”

Other powerful people in Puerto Rico continue to view the legacy of industrialization and federal aid as positive, noting progress in education and literacy. They view U.S. tax breaks as a tool promoting autonomy, not dependency. In a speech last week, outgoing Governor Alejandro Garcia Padilla lauded Puerto Rico’s “unparalleled relationship with the federal government.”

‘DON’T GO BACKWARDS’

Locals are increasingly embracing entrepreneurship in an economy where getting a job has gotten tougher.

One sign of progress: Puerto Ricans are starting businesses at a rate typical of some 60 countries studied in the 2015 Global Entrepreneurship Monitor, although far fewer than average ever get up and running. Business accelerator programs such as Parallel 18, a government-funded grant program for startups who operate in Puerto Rico, are gaining traction.

Capital is slowly coming to the island, too. Cantero’s Grupo Guayacan is stepping up its startup financing efforts on the island. And Medina, the former PRIDCO chief, is building a fund to invest in what he calls “demand-driven entrepreneurship”- identifying services that big companies in Puerto Rico want to outsource to local suppliers, and then financing their creation.

More help is needed in nurturing nascent companies, says Sebastian Vidal, Parallel 18’s executive director. Vidal, who was recruited by Puerto Rico’s government after running a similar program in Chile, says the strongest applications that Parallel 18 receives tend to be from outside Puerto Rico, and that just 19 of 64 grantees so far are locals.

Still, the entrepreneurial spirit is alive, which some interpret as a thirst for the self-determination Puerto Rico has never had.

Prudo Jimenez this year started planting cacao trees on a five-acre sliver of his farm. He hopes to start selling the fruit when the trees mature in a few years.

“My father had a saying,” Jimenez said. “Don’t go backwards, even to get momentum. Keep fighting until you expire.”

(This story has been refiled to remove a repeated quotation and fix a plural reference)

(Reporting by Nick Brown; additional reporting by Robin Respaut; editing by Brian Thevenot)

By Nick Brown

Special Report: How dependence on tax breaks corroded Puerto Rico's economy

Special Report: How dependence on tax breaks corroded Puerto Rico's economy