El Índice de Actividad Económica (IAE) de Puerto Rico para abril se redujo en un 1.3%, si se compara con el mismo mes del año pasado. Se trata de una baja que, acumulada con otras ocurridas en este año fiscal, representan una reducción en la actividad económica de un 3.3%.

El indicador fue publicado anoche por el Banco Gubernamental de Fomento (BGF) y ofrece una serie de comentarios que buscan explicar la razón de la baja.

De acuerdo con el documento, aunque los empleos no agrícolas aumentaron en abril en un 0.2%, la cifra para lo que va de año arroja números negativos. De hecho, se detalla que los empleos en el sector privado aumentaron en un 1.6% para abril pero en el sector gubernamental bajaron 3.5%.

Otro asunto que influyó en el IAE es la producción energética que decayó un 2% con la generación de 1,713 millones de kilovatios-hora. Las ventas de cemento también siguen decayendo. Se vendieron para abril 1.29 millones de sacos, lo que representa una reducción de 17.5%.

Desde enero de 2006 el IAE ha mostrado una tendencia clara a la baja, ilustrando la crisis económica que vive el País.

Por Ricardo Cortés Chico / rcortes@elnuevodia.com

Continúa en declive la actividad económica de la Isla - El Nuevo Día

Aujourd'hui, les Réseaux d'Information répond aux besoins d'informations précises sur les événements survenant sur le terrain.

Saturday, May 31, 2014

Recent Study: Puerto Rico Pharmaceuticals & Healthcare Report Q3 2014 - Press Release

Fast Market Research recommends "Puerto Rico Pharmaceuticals & Healthcare Report Q3 2014" from Business Monitor International, now available

Boston, MA -- (SBWIRE) -- 05/30/2014 -- BMI View: The pharmaceutical manufacturing industry will continue to be an economic mainstay for Puerto Rico. However, the country is gradually losing attractiveness as a global pharmaceutical production hu b, despite the diversification to the generic and biologic drug production.Headline Expenditure Projections

- Pharmaceuticals: USD3.02bn in 2013 to USD3.02bn in 2014; +0.2% in local currency terms. Forecast is below the previous quarter's projection due to new historical numbers.

- Healthcare: USD7.76bn in 2013 to USD8.02bn in 2014; +3.4% in local currency terms. Forecast below Q214 due to less promising macroeconomic outlook.

Risk/Reward Rating: Due to its modest size and worsening longer-term outlook, Puerto Rico slipped from the third place in our RRRs for the Americas region down to the fifth after the US, Canada, Brazil and Mexico in Q314. Globally, Puerto Rico ranks highly in terms of its business environment, largely due to its sophisticated IP laws and political stability, although its uncompetitive labour force has increasingly come under scrutiny.

View Full Report Details and Table of Contents

Key Trends and Developments

- In February 2014, Puerto Rico's Senate plans its investigation of the sudden rise in the cost of generic drugs in the country.

- In January 2014, Mexican drugmaker Neolpharma established a new Development and Innovation Center (CEDIPROF) for new pharmaceutical products in Puerto Rico.

BMI Economic View: The Puerto Rican government's recent oversubscribed USD3.5bn debt issuance significantly lowered the risk of a technical default, which had grown in recent months. We now believe that debt restructuring is unlikely before the end of fiscal year 2015 given the recent boost in liquidity. However, beyond that timeframe, unfavourable population and labour market dynamics, which weigh on fiscal revenue growth, still leave Puerto Rico's debt obligations at high risk of restructuring.

BMI Political View: We see rising scope for social and political tensions to increase in...

The Puerto Rico Pharmaceuticals & Healthcare Report features Business Monitor International (BMI)'s forecasts for drugs and healthcare expenditure and imports and exports, focusing on the growth outlook for the prescription, OTC, patented drugs and generics market segments.

BMI's Puerto Rico Pharmaceuticals & Healthcare Report provides industry professionals, strategists, company executives, investors, analysts and sales/marketing heads with independent forecasts and competitive intelligence on the Puerto Rican pharmaceutical and healthcare industry.

Key Benefits

- Benchmark BMI's independent pharmaceutical and healthcare industry forecasts for Puerto Rico to test other views - a key input for successful budgeting and strategic business planning in the Puerto Rican pharmaceutical and healthcare market.

About Fast Market Research

Fast Market Research is a leading distributor of market research and business information. Representing the world's top research publishers and analysts, we provide quick and easy access to the best competitive intelligence available. Our unbiased, expert staff is always available to help you find the right research to fit your requirements and your budget. For more information about these or related research reports, please visit our website at http://www.fastmr.com or call us at 1.800.844.8156 begin_of_the_skype_highlighting

1.800.844.8156 FREE end_of_the_skype_highlighting .

1.800.844.8156 FREE end_of_the_skype_highlighting .Browse all Healthcare research reports at Fast Market Research

You may also be interested in these related reports:

- Puerto Rico Pharmaceuticals & Healthcare Report Q2 2014

- Thailand Pharmaceuticals & Healthcare Report Q3 2014

- Nigeria Pharmaceuticals & Healthcare Report Q3 2014

- Australia Pharmaceuticals & Healthcare Report Q3 2014

- Central America Pharmaceuticals & Healthcare Report Q3 2014

- Mexico Pharmaceuticals & Healthcare Report Q3 2014

- Croatia Pharmaceuticals & Healthcare Report Q3 2014

- Latvia Pharmaceuticals & Healthcare Report Q3 2014

- Algeria Pharmaceuticals & Healthcare Report Q3 2014

- Kenya Pharmaceuticals & Healthcare Report Q3 2014

For more information on this press release visit: http://www.sbwire.com/press-releases/recent-study-puerto-rico-pharmaceuticals-healthcare-report-q3-2014-512584.htm

Media Relations Contact

Bill ThompsonDirector of Marketing

Fast Market Research, Inc.

Telephone: 800-844-8156 begin_of_the_skype_highlighting

800-844-8156 FREE end_of_the_skype_highlighting

800-844-8156 FREE end_of_the_skype_highlightingEmail: Click to Email Bill Thompson

Web: http://www.fastmr.com

Read more: http://www.digitaljournal.com/pr/1952061#ixzz33IEt5oXf

Recent Study: Puerto Rico Pharmaceuticals & Healthcare Report Q3 2014 - Press Release - Digital Journal

Puerto Rico is burning oil to generate electricity: It’s completely insane.

PREPA, the troubled Puerto Rico Electric Power Authority, is having difficulty coming up with the money to pay for its latest petroleum delivery. AsCaribbean Business reported, the utility last week decided to take cash from its capital works fund—up to $100 million—to buy oil. Usually, PREPA would use existing lines of credit to make such purchases. But the recent downgrades of Puerto Rico’s public debt have made that more challenging.

Puerto Rico has a host of problems. Its economy has been in recession since 2006, and investors are fretting that it may not be able to make good on its $70 billion in municipal bonds. A goodly chunk of its population has decamped to Florida. In the scheme of things, borrowing from an infrastructure fund to pay for fuel oil seems like a drop in a very large bucket.

Nonetheless, WTF? Why is Puerto Rico buying $100-per-barrel oil to make electricity?

There are lots of ways to generate electricity. You can burn fossil fuels like coal, or natural gas, or oil. You can harness the power of rushing water, or the light of the sun, or the wind. You can burn biomass, or garbage waste. Or you can tap landfills for methane gas.

Among these many options, none possesses the lethal combination of high costs and deleterious environmental impact that torching petroleum does. According to theEnvironmental Protection Agency, burning oil to create electricity emits about 50 percent more carbon dioxide per megawatt-hour than natural gas and only about 25 percent less than coal, while producing nearly as much sulfur dioxide and nitrogen oxides as coal does. Meanwhile, with oil at $100 a barrel, shipping in oil over a long distance and then burning it is an extremely costly way of generating electricity.

That’s why America has pretty much given up on petroleum as an electricity-generating fuel. According to the Energy Information Administration, petroleum liquids accounted for about 2.5 percent of U.S. electricity generation in 2004, or 100,391 thousand megawatt-hours. By last year, that amount had fallen by 86 percent, and petroleum liquids accounted for just 0.3 percent of total electricity generation. In general, the U.S. electricity fleet has swapped in cleaner-burning natural gas and renewables for coal and oil.

Not so much in Puerto Rico. As the Energy Information Administration notes, in 2012, “65% of Puerto Rico’s electricity came from petroleum, 18% from natural gas, 16% from coal, and 1% from renewable energy.” As PREPA’s list of major power plants shows, many of its biggest plants use either fuel oil No. 6 (the heavy, dirty version that New York City has banned), or Fuel Oil No. 2, which costs about $3 per gallon. (Here’s a long-term chart of heating oil No. 2.) Would it surprise you to learn that Puerto Rico’s electricity costs—at about 27 cents per kilowatt-hour—are about twice what they are on the mainland? The continued reliance on oil is both a symptom and a cause of Puerto Rico’s woes. The high electricity cost functions as a tax on business and industry and as a pernicious regressive tax on consumers.

Historically, island states, such as Puerto Rico and Hawaii, that lack their own supplies of natural gas and coal haven’t had much choice but to rely on petroleum. And to its credit, Puerto Rico is trying to pump up its use of natural gas. One of the biggest plants on the island, the 540-megawatt EcoEléctrica facility, runs on fuel that arrives by ship as liquefied natural gas from Trinidad and Tobago and is processed at the Peñuelas terminal. The same terminal, on Puerto Rico’s southern coast, also feeds the nearby Costa Sur station in Guayanilla, which has been converted from oil to run on natural gas. But Puerto Rico lacks the expensive infrastructure (new terminals, pipeline networks) to convert all its oil-fueled plants quickly. Worse, it lacks the capital and borrowing capacity to build this infrastructure.

Pumping up renewables would help, too. Renewables can’t be relied upon for what’s known as base load—the sun doesn’t shine at night, and the wind doesn’t always blow. But sun and wind can be a significant part of generation—wind farms planted strategically on mountain ridges, or solar panels arrayed on unused farmland or on the tops of big-box stores, schools, and homes. In Texas, wind alone accounts for about 10 percent of electricity generation. On a weekend day in March, solar alone accountedfor about 18 percent of California’s electricity. As this cool, daily, real-time chart from Hawaii’s biggest utility shows, during the middle of the day, renewables can easily supply up to 20 percent of Hawaii’s electricity needs.

But Puerto Rico, where the typical person uses only about 40 percent of the amount of energy of a typical American, is behind the curve when it comes to renewables. As EIA notes, “Only about 1% of Puerto Rico's electricity has been coming from renewable energy sources, all from hydroelectricity.” Building more solar and wind projects isn’t just smart energy policy for a tropical island state like Puerto Rico; it’s smart economic development policy. Doing so would create jobs, help incubate new industries, and provide cheaper electricity, which would be a boon to consumers and businesses.

By Daniel Gross

Puerto Rico is burning oil to generate electricity: It’s completely insane.

Friday, May 30, 2014

Actavis Investing $48M In Puerto Rico Plants

SAN JUAN, Puerto Rico (AP) -- Drug maker Actavis Plc is investing $48 million to reactivate and expand two manufacturing plants in the U.S. territory of Puerto Rico.

Gov. Alejandro Garcia Padilla says Actavis expects to produce about 2.5 billion tablets at a pharmaceutical plant in the north coastal town of Manati that previously served as a warehouse. Actavis also will expand a manufacturing plant based in the northeast coastal town of Fajardo.

Both plants were previously owned by Warner Chilcott, which Actavis bought in 2013 for $8.5 billion.

Garcia said Wednesday that some 300 jobs will be created in the next three years.

Actavis is based in Ireland and has grown in recent years as a result of several multibillion-dollar deals.

Actavis Investing $48M In Puerto Rico Plants

Gov. Alejandro Garcia Padilla says Actavis expects to produce about 2.5 billion tablets at a pharmaceutical plant in the north coastal town of Manati that previously served as a warehouse. Actavis also will expand a manufacturing plant based in the northeast coastal town of Fajardo.

Both plants were previously owned by Warner Chilcott, which Actavis bought in 2013 for $8.5 billion.

Garcia said Wednesday that some 300 jobs will be created in the next three years.

Actavis is based in Ireland and has grown in recent years as a result of several multibillion-dollar deals.

Actavis Investing $48M In Puerto Rico Plants

Puerto Rico is on the road to economic recovery

Whether it’s the government of Puerto Rico’s recent bond offering or new investment by major multinational companies on our Island, the Commonwealth of Puerto Rico has been in the news quite a bit in recent months -- and members of Congress and the Obama administration are paying close attention.

In fact, this week the Congressional Hispanic Leadership Institute is hosting a forum on Capitol Hill focused on the economic situation in Puerto Rico. While there is still more that needs to be done to get our economy back on track, Puerto Rico has come a long way in the last year and a half, thanks to a combination of both innovative ideas and tough choices by Gov. García Padilla to create sustainable economic growth.

Yet, in order to sustain the economic turnaround, Congress needs to meet its responsibility by restoring its partnership through tax incentives for U.S. manufacturing in the Island. It is no coincidence that Puerto Rico’s recession began in 2006, the final year of the congressionally mandated phase-out of Section 936 of the IRS Code that incentivized U.S. manufacturing in Puerto Rico. The consequences of that ill-fated decision are still being felt today with tens of thousands of U.S. jobs lost and the expected tax revenues going abroad, and not to the U.S. Treasury as was hoped. The current discussions on federal tax reform provide the perfect opportunity to renew the historic partnership between Congress and Puerto Rico that for decades proved to be enormously beneficial to both economies.

Meanwhile, Puerto Rico is doing its part to foster growth and create jobs. Recent decisions by multinational companies to set up operations in Puerto Rico shows that our economic development strategy is working. In the past year alone, industry leaders like Lufthansa, Honeywell, Infosys, Actavis, Infotech Aerospace Services, and Seaborne Airlines have expanded operations on the Island. These companies are utilizing the talent on the Island and creating well-paying jobs. Better yet, they are attracting small businesses to the region, creating new opportunities for entrepreneurs and workers in Puerto Rico and helping strengthen the economy for the long-term. The growing manufacturing sector combined with agriculture, tourism and education development initiatives will guide Puerto Rico towards a knowledge economy.

Another key component of the recovery plan is getting the Island’s fiscal house in order. Puerto Rico has taken significant steps to cut government spending, including streamlining professional-service contracts and reforming the public pension system. Most recently, Padilla presented the first balanced budget in more than two decades. With the new balanced budget the administration is working towards a more modern, effective and efficient government that operates within its means.

During his State of the Commonwealth address in April, Padilla outlined his strategic plan to get the economy back on track with job creation and economic growth that diversifies our industrial base by utilizing Puerto Rico’s established manufacturing industry, and targeting life sciences and knowledge based industries for growth, like companies in the aerospace and defense sectors. The governor has also signaled his intention to move forward with a tax reform initiative that promotes economic development and supports the necessary infrastructure to compete in today’s global economy. To help us achieve this, we are investing in our people – our most important asset.

We are thankful for the partnership we have enjoyed with the White House, several federal agencies such as the U.S. Departments of Commerce, Transportation and Homeland Security, and Congress. Now is the time to take that momentum to the next level and enact policies to boost Puerto Rico’s economy with a new federal tax incentive. U.S. jobs are at stake both stateside and in the Island, and our manufacturing base will continue to grow as a result.

We have a strong vision for modernizing Puerto Rico’s economy and look forward to continuing to work closely with officials in Washington, D.C. to continue to build on the progress we’ve made in recent years to ensure the people of Puerto Rico have the quality of life they deserve.

Hernández is the director of the Puerto Rico Federal Affairs Administration, which is the Office of the Governor in Washington, D.C.

Read more: http://thehill.com/blogs/congress-blog/economy-budget/207472-puerto-rico-is-on-the-road-to-economic-recovery#ixzz33CMGav4O

Follow us: @thehill on Twitter | TheHill on Facebook

By Juan E. Hernández

Puerto Rico is on the road to economic recovery | TheHill

In fact, this week the Congressional Hispanic Leadership Institute is hosting a forum on Capitol Hill focused on the economic situation in Puerto Rico. While there is still more that needs to be done to get our economy back on track, Puerto Rico has come a long way in the last year and a half, thanks to a combination of both innovative ideas and tough choices by Gov. García Padilla to create sustainable economic growth.

ADVERTISEMENT

Meanwhile, Puerto Rico is doing its part to foster growth and create jobs. Recent decisions by multinational companies to set up operations in Puerto Rico shows that our economic development strategy is working. In the past year alone, industry leaders like Lufthansa, Honeywell, Infosys, Actavis, Infotech Aerospace Services, and Seaborne Airlines have expanded operations on the Island. These companies are utilizing the talent on the Island and creating well-paying jobs. Better yet, they are attracting small businesses to the region, creating new opportunities for entrepreneurs and workers in Puerto Rico and helping strengthen the economy for the long-term. The growing manufacturing sector combined with agriculture, tourism and education development initiatives will guide Puerto Rico towards a knowledge economy.

Another key component of the recovery plan is getting the Island’s fiscal house in order. Puerto Rico has taken significant steps to cut government spending, including streamlining professional-service contracts and reforming the public pension system. Most recently, Padilla presented the first balanced budget in more than two decades. With the new balanced budget the administration is working towards a more modern, effective and efficient government that operates within its means.

During his State of the Commonwealth address in April, Padilla outlined his strategic plan to get the economy back on track with job creation and economic growth that diversifies our industrial base by utilizing Puerto Rico’s established manufacturing industry, and targeting life sciences and knowledge based industries for growth, like companies in the aerospace and defense sectors. The governor has also signaled his intention to move forward with a tax reform initiative that promotes economic development and supports the necessary infrastructure to compete in today’s global economy. To help us achieve this, we are investing in our people – our most important asset.

We are thankful for the partnership we have enjoyed with the White House, several federal agencies such as the U.S. Departments of Commerce, Transportation and Homeland Security, and Congress. Now is the time to take that momentum to the next level and enact policies to boost Puerto Rico’s economy with a new federal tax incentive. U.S. jobs are at stake both stateside and in the Island, and our manufacturing base will continue to grow as a result.

We have a strong vision for modernizing Puerto Rico’s economy and look forward to continuing to work closely with officials in Washington, D.C. to continue to build on the progress we’ve made in recent years to ensure the people of Puerto Rico have the quality of life they deserve.

Hernández is the director of the Puerto Rico Federal Affairs Administration, which is the Office of the Governor in Washington, D.C.

Read more: http://thehill.com/blogs/congress-blog/economy-budget/207472-puerto-rico-is-on-the-road-to-economic-recovery#ixzz33CMGav4O

Follow us: @thehill on Twitter | TheHill on Facebook

By Juan E. Hernández

Puerto Rico is on the road to economic recovery | TheHill

Wednesday, May 28, 2014

Puerto Rico bank, government clash over $230M

SAN JUAN, Puerto Rico — Puerto Rico’s government and one of the island’s biggest banks are locked in a heated battle over $230 million as both sides struggle to regain their financial footing in a wobbly economy.

The dispute between the Treasury Department and Doral Financial Corp. escalated this month when the government announced it was nullifying a multimillion-dollar agreement with the bank, leading a former top U.S. economic official advising the bank to warn on Tuesday that such a move would further spook investors.

“It’s not an option for the government of Puerto Rico to issue that refund. They are legally, politically and morally obliged to do so,” said economist Robert Shapiro, who was undersecretary of commerce in President Bill Clinton’s administration and is now an adviser for Doral Bank.

Barbara Morgan, a spokeswoman for the Treasury Department, declined to comment. She said the agency does not publicly discuss tax-related claims and disputes with taxpayers.

The dispute comes as the U.S. territory enters its eighth year in recession and struggles to pay down $70 billion in public debt.

Doral Bank says it is owed a $230 million refund in overpaid taxes and has criticized the government for announcing that the agreement was no longer valid.

Melba Acosta, Puerto Rico’s treasury secretary, has said the government was nullifying the 2012 agreement in part because the statute of limitations had run out and because the deal was not recognized in the government’s accounting books at the end of that fiscal year. The government also has said the bank did not provide any evidence proving it is owed that amount for overpaid taxes.

U.S. regulators have said Doral Bank can no longer include that amount on its balance sheet. In December, the $230 million accounted for about one-third of the $679 million in the bank’s Tier 1 capital, which is an indicator of a bank’s financial health.

Shapiro said the bank has several options, including raising more capital or reaching an agreement with the U.S. Federal Deposit Insurance Corporation.

“Puerto Rico has been suffering from a very seriously underperforming economy for some time,” Shapiro said. “There are already issues of liquidity arising in respect to Puerto Rico, and placing at risk another major financial institution on the island certainly is not what an economist would recommend.”

Doral Bank has approximately 300,000 clients and is Puerto Rico’s third-largest bank in assets.

Copyright 2014 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Puerto Rico bank, government clash over $230M

The dispute between the Treasury Department and Doral Financial Corp. escalated this month when the government announced it was nullifying a multimillion-dollar agreement with the bank, leading a former top U.S. economic official advising the bank to warn on Tuesday that such a move would further spook investors.

“It’s not an option for the government of Puerto Rico to issue that refund. They are legally, politically and morally obliged to do so,” said economist Robert Shapiro, who was undersecretary of commerce in President Bill Clinton’s administration and is now an adviser for Doral Bank.

Barbara Morgan, a spokeswoman for the Treasury Department, declined to comment. She said the agency does not publicly discuss tax-related claims and disputes with taxpayers.

The dispute comes as the U.S. territory enters its eighth year in recession and struggles to pay down $70 billion in public debt.

Doral Bank says it is owed a $230 million refund in overpaid taxes and has criticized the government for announcing that the agreement was no longer valid.

Melba Acosta, Puerto Rico’s treasury secretary, has said the government was nullifying the 2012 agreement in part because the statute of limitations had run out and because the deal was not recognized in the government’s accounting books at the end of that fiscal year. The government also has said the bank did not provide any evidence proving it is owed that amount for overpaid taxes.

U.S. regulators have said Doral Bank can no longer include that amount on its balance sheet. In December, the $230 million accounted for about one-third of the $679 million in the bank’s Tier 1 capital, which is an indicator of a bank’s financial health.

Shapiro said the bank has several options, including raising more capital or reaching an agreement with the U.S. Federal Deposit Insurance Corporation.

“Puerto Rico has been suffering from a very seriously underperforming economy for some time,” Shapiro said. “There are already issues of liquidity arising in respect to Puerto Rico, and placing at risk another major financial institution on the island certainly is not what an economist would recommend.”

Doral Bank has approximately 300,000 clients and is Puerto Rico’s third-largest bank in assets.

Copyright 2014 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Puerto Rico bank, government clash over $230M

Monday, May 26, 2014

Investing In Puerto Rico's Future | Seeking Alpha

Summary

- There is a systemic effort to invest in Puerto Rico's tourism industry.

- Presently there is an endeavor to lure wealthy investors from the mainland to Puerto Rico.

- There's an effort to stabilize and strengthen Puerto Rico's main bank.

- One can participate in Puerto Rico’s economic recovery through a plethora of tangible assets and municipal bond ETFs.

Amidst these seemingly insurmountable odds, there are beacons of light that suggest Puerto Rico is "down but not out". There is a systemic effort to invest in Puerto Rico's tourism industry. For example, Matt Karp, who is the Chief Acquisition Officer and Principal of the Caribbean Property Group (CPG), was actively involved in the successful financing of the world class Ritz Carlton Reserve Project in Dorado, Puerto Rico. In addition, hedge fund billionaire John Paulson is investing $260 million this year in an ambitious project, which brings two hotels to Puerto Rico's capital San Juan. Multiple hedge funds have expressed interest in investing in Puerto Rico's future.

Mr. Paulson was quoted saying the following: "We are investing here because we feel we are getting involved in the ground floor. I think tomorrow the island will develop into the Singapore of the Caribbean." One major benefit to investing in Puerto Rico and Singapore is a law that allows new residents to avoid taxes on capital gains. Capital gains are the central focus for several hedge funds and high-end investors. Paulson believes Puerto Rico's future is bright because its economy is getting better. Also, Former Secretary of Labor and current candidate for Mayor of San Juan, Miguel Romero suggested a new law that would eliminate the construction tax. This law will entice new businesses from the mainland to invest and set up shop in Puerto Rico.

Furthermore, there is an effort to stabilize and strengthen Puerto Rico's main bank, Banco Popular. Matt Karp was in charge of commercial acquisitions with loan balances ranging from a million dollars and above, during the recent Banco Popular sale of $540 million in non-performing commercial and construction loans and real estate. Under the terms of the sale agreement, Banco Popular will provide an advance facility of approximately $35 million. The facility will cover cost-to-complete amounts and expenses of certain projects. Banco Popular will also provide approximately $30 million in the form of working capital line to fund certain operation expenses interest for the borrower. In return, Banco Popular will receive approximately $99 million in cash, a note for approximately $182 million as seller financing and a 24.9% equity interest for the borrower.

Mark Lipschutz, partner and CEO of Caribbean Property Group, stated the following after the acquisitions and commercial revitalization. "This transaction evidences that our commitment to Puerto Rico remains as strong as ever". The commitment of economic investments can provide the panacea for Puerto Rico's economic woes. In similar fashion during the 50's, Laurence Rockefeller had a vision to the Dorado property into a resort and historic natural gem sanctuary. Mr. Rockefeller's dream was completed and displayed to the public on December 1, 1958.

Also, Richard Carrion, the current chairman and CEO of President of Banco Popular, assessed Puerto Rico's economy by focusing on two important factors during a recent interview. "I think the most important thing is to regain growth," said Carrion, who is particularly concerned about two statistics: the fall of the population and low labor force participation rate, which is around 40%. "I had never seen it before. It is a fundamental issue that needs to be reversed."

Total employment in the island has declined from 1,139,878 in January, 2009 to 1,009,555 in January 2014. Over the past decade, 450,000 citizens in Puerto Rico have left the island.

According to statements made by Puerto Rico's representative in Congress, Pedro Pierluisi, Puerto Rico loses between two and three billion dollars because of its territorial status. Recently, there has been a trendy "movement" towards Statehood status. In the most recent referendum (2012), Puerto Ricans voted 61.6% for Statehood, 33.34% for free association (the current Commonwealth status) and 5.49% for independence.

As stated by the Puerto Rico's Federal Affairs Office, more than 10,000 Puerto Ricans are active duty members of the U.S. military and the island is home to more than 120,000 veterans. Also USAG Fort Buchanan consists of 746.16 acres between the municipalities of Bayamon and Guaynabo, Puerto Rico and has a real estate value estimated at $560 million. This real estate value continues to grow exponentially. Fort Buchanan serves a population of approximately 130,000 combined between military personnel and their dependents, retirees, veterans, civilians in Puerto Rico.

The time to invest in Puerto Rico is now by establishing tangible assets. Enterprising groups can purchase real estate properties, like factories and prime outlets with several tax incentives. All of these developments are indicators that Puerto Rico is still of strategic value to the United States and its economic engine will have a sustainable growth impact. Puerto Rico has been hit hard by the poor economy. Nevertheless, the island was able to sell a record $3.5 billion in bonds last March.

For those searching for market-traded investments, PowerShares insured New York Mini Bond ETF (PZT), currently yielding 3.93%, is a valuable option to consider. The ETF has several Puerto Rico bonds which comprise a substantial percentage of the New York portfolio. For instance, 5% of the fund's assets are in the Puerto Rico Commonwealth Aqueduct bonds with a coupon yield of 5.125%. Additionally, it has over 4.2% of its funds in Puerto Rico Commonwealth Highway and Transit 5.25% bonds. Many investors believe Puerto Rico's economy is getting better and will reach its apex in three to four years.

Tax benefit flows through ETFs. The biggest benefit in investing in Puerto Rico bonds is their exception of state and federal income tax.

Investing In Puerto Rico's Future | Seeking Alpha

Friday, May 23, 2014

New home sales rebound, inventories at 3-1/2 year high

WASHINGTON (Reuters) - Sales of new U.S. single-family homes rose more than expected in April and the stock of houses on the market hit a 3-1/2 year-high, further signs the sputtering housing recovery was poised to regain steam.

Related Stories

- New-home sales likely rebounded in April, economists forecast MarketWatch

- Average US 30-year mortgage rate falls to 4.21 pct Associated Press

- US home sales rose 1.3 percent in April Associated Press

- Average US 30-year mortgage rate dips to 4.2 pct. Associated Press

- [$$] Existing Home Sales Rise for First Time This Year The Wall Street Journal

The Commerce Department said on Friday sales increased 6.4 percent to a seasonally adjusted annual rate of 433,000 units, ending two straight months of declines.

March's sales pace was revised up to 407,000 units from a previously reported 384,000 units.

The government made revisions to the model it uses to adjust the data for seasonal fluctuations, which affected only the monthly data.Economists polled by Reuters had forecast new home sales at a 425,000-unit pace last month. Compared to April last year, sales were down 4.2 percent.

A run-up in mortgage rates last year and rising home prices, which have outpaced wage growth, are weighing on housing. Home sales are also being hampered by a shortage of properties.

But there are signs a turnaround is imminent.

Sales of previously owned homes increased in April and the inventory of houses was the highest in nearly two years, a report showed on Thursday.

According to Freddie Mac, the fixed 30-year mortgage rate fell to an average of 4.14 percent this week, a near seven-month low, from an average of 4.20 percent the prior week. That should help to improve affordability.

Last month, new home sales jumped in the Midwest to their highest level since November 2007. Sales also rose in the South, but were flat in the West. In the Northeast, sales recorded their largest decline since October 2012.

The inventory of new houses on the market increased 0.5 percent to 192,000 units, the highest level since November 2010. While the stock of new houses on the market has come off a record low hit in July 2012, it remains less than half of its pre-recession level.

At April's sales pace it would take 5.3 months to clear the supply of houses on the market, down from 5.6 months in March. With inventories improving, the median price of a new home last month fell 1.3 percent to $275,800 from April last year.

(Reporting by Lucia Mutikani; Editing by Andrea Ricci)

New home sales rebound, inventories at 3-1/2 year high

Thursday, May 22, 2014

Puerto Rico wants to diversify its economy, official says

Puerto Rico's secretary of economic development and trade, Alberto Baco Bague, said in an interview with Efe here that the island wants to move toward a more balanced and diversified economy with more weight on services, tourism and agriculture after its heretofore "total" dependence on the manufacturing sector.

Puerto Rico's economy is in a process of transformation that will give greater presence to new sectors, given that currently 50 percent of the island's income comes from manufacturing, something that creates great dependence on that sector, Baco said.

Tourism, agriculture and services are the segments that the island wants to promote and, to do that, the Puerto Rican government is pushing for "aggressive" fiscal laws that will allow the establishment of businesses, Baco said.

Those regulations will allow the "fiscal autonomy" accorded to Puerto Rico by its status as a U.S. commonwealth, a situation that the government is not intending to modify, the official said.

"Our government is completely in favor of maintaining the status we have. The commonwealth is an extraordinary tool for economic development and we're testing it with all the projects we're promoting," Baco said.

In the past "there were those who said the commonwealth's moment had passed. It's not that way. What's happening is that there were so many changes of government and many years in which whoever governed Puerto Rico didn't believe in it that they didn't adequately use the tools the commonwealth provides," Baco said.

Puerto Rico has a "high" level of indebtedness, but the island's economy is "at an inflection point" that will give way to growth, Baco added.

Over the next two years, there are investment projects totaling $12 billion in the works, a situation that will increase the gross domestic product and will allow the debt to be reduced, he said.

Bond investors who participated in the auction in March, when $3.5 billion in bonds were sold, showed that they have confidence in the fact that Puerto Rico "is going to pay its debts," Baco said. EFE

Puerto Rico wants to diversify its economy, official says

Puerto Rico's economy is in a process of transformation that will give greater presence to new sectors, given that currently 50 percent of the island's income comes from manufacturing, something that creates great dependence on that sector, Baco said.

Tourism, agriculture and services are the segments that the island wants to promote and, to do that, the Puerto Rican government is pushing for "aggressive" fiscal laws that will allow the establishment of businesses, Baco said.

Those regulations will allow the "fiscal autonomy" accorded to Puerto Rico by its status as a U.S. commonwealth, a situation that the government is not intending to modify, the official said.

"Our government is completely in favor of maintaining the status we have. The commonwealth is an extraordinary tool for economic development and we're testing it with all the projects we're promoting," Baco said.

In the past "there were those who said the commonwealth's moment had passed. It's not that way. What's happening is that there were so many changes of government and many years in which whoever governed Puerto Rico didn't believe in it that they didn't adequately use the tools the commonwealth provides," Baco said.

Puerto Rico has a "high" level of indebtedness, but the island's economy is "at an inflection point" that will give way to growth, Baco added.

Over the next two years, there are investment projects totaling $12 billion in the works, a situation that will increase the gross domestic product and will allow the debt to be reduced, he said.

Bond investors who participated in the auction in March, when $3.5 billion in bonds were sold, showed that they have confidence in the fact that Puerto Rico "is going to pay its debts," Baco said. EFE

Puerto Rico wants to diversify its economy, official says

Wednesday, May 21, 2014

Fitch: Puerto Rican Banks Weighed Down by Weak Island Economy

(The following statement was released by the rating agency) NEW YORK, May 20 (Fitch) Weak economic fundamentals in Puerto Rico and ongoing budgetary challenges for the island's government are likely to weigh on the operating performance and credit profiles of local banks, according to Fitch Ratings.

Economic conditions in Puerto Rico have kept the non-performing assets (NPAs) of banks on the island very high relative to U.S. midtier and community bank peer groups. Combined, the NPA rate of Fitch-rated Puerto Rican banks was 11.9% at the end of 4Q13, compared with 2.5% for mainland peers.

Unemployment in Puerto Rico remains high, running at over 14%. Labor market conditions are restraining recovery potential in the local housing market and worsening the recoveries on defaulted loans. The government's high debt levels, pension funding requirements and still-sluggish growth have exacerbated the banks' challenges. The core deposit base of the Puerto Rican banks is not sufficient to support local banks' funding requirements. Heavy reliance on non-core funding, particularly brokered CDs and other wholesale sources, could constrain liquidity if economic conditions worsen. Doral Financial (DRL), which had $1.4 billion in brokered deposits at year end 2013, or 28% of total deposits and 18% of total funding, saw its use of brokered deposits frozen by the FDIC on May 1.

The bank must resubmit a revised capital plan to resume access to the brokered deposit market. DRL's IDR was downgraded to 'C' from 'CCC' on May 5. Maintaining a good measure of stability in the Puerto Rican banks' capital positions is critical to supporting current ratings in light of the poor economic environment. Favorably, most banks' capital positions have improved somewhat over the past two years as a result of equity issuances that have helped to shore up credit quality.

While all of Puerto Rico's banks have suffered from market weakness, DRL entered 2014 as already the weakest of the island's rated banks. The FDIC advised the bank and the Office of Financial Commissions, Puerto Rico's local bank regulator, that it could no longer include some or all of certain tax receivables due from the government of Puerto Rico as part of its Tier 1 capital calculation. The tax receivables, totaling $289 million, account for roughly 43% of DRL's current Tier 1 capital. With the exclusion of these assets, DRL is no longer compliant with its minimum regulatory capital requirement.

For most of Puerto Rico's banks, better profitability will be key in determining whether capital ratios and other financial measures can continue improving in the face of macro headwinds. For a full analysis of Puerto Rican bank credit profiles, as well as a discussion of the impact that weak economic fundamentals are having on banks' operating environment, see the Fitch special report "Puerto Rican Banks: Difficult Operating Environment Constrains Ratings," dated May 20, 2014, at www.fitchratings.com.

Contact: Doriana Gamboa Director Financial Institutions +1 212 908-0865 33 Whitehall Street New York, NY Matthew Noll, CFA Senior Director Fitch Wire +1 212 908-1652 begin_of_the_skype_highlighting  +1 212 908-1652 FREE end_of_the_skype_highlighting Media Relations: Brian Bertsch, New York, Tel: +1 212-908-0549 begin_of_the_skype_highlighting

+1 212 908-1652 FREE end_of_the_skype_highlighting Media Relations: Brian Bertsch, New York, Tel: +1 212-908-0549 begin_of_the_skype_highlighting  +1 212-908-0549 FREE end_of_the_skype_highlighting , Email: brian.bertsch@fitchratings.com.

+1 212-908-0549 FREE end_of_the_skype_highlighting , Email: brian.bertsch@fitchratings.com.

+1 212 908-1652 FREE end_of_the_skype_highlighting Media Relations: Brian Bertsch, New York, Tel: +1 212-908-0549 begin_of_the_skype_highlighting

+1 212 908-1652 FREE end_of_the_skype_highlighting Media Relations: Brian Bertsch, New York, Tel: +1 212-908-0549 begin_of_the_skype_highlighting  +1 212-908-0549 FREE end_of_the_skype_highlighting , Email: brian.bertsch@fitchratings.com.

+1 212-908-0549 FREE end_of_the_skype_highlighting , Email: brian.bertsch@fitchratings.com. Additional information is available on www.fitchratings.com. The above article originally appeared as a post on the Fitch Wire credit market commentary page. The original article, which may include hyperlinks to companies and current ratings, can be accessed at www.fitchratings.com. All opinions expressed are those of Fitch Ratings.

Applicable Criteria and Related Research: Puerto Rican Banks: Difficult Operating Environment Constrains Ratings here ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK: here. IN ADDITION, RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY'S PUBLIC WEBSITE 'WWW.FITCHRATINGS.COM'.

PUBLISHED RATINGS, CRITERIA AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH'S CODE OF CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE 'CODE OF CONDUCT' SECTION OF THIS SITE.

FITCH MAY HAVE PROVIDED ANOTHER PERMISSIBLE SERVICE TO THE RATED ENTITY OR ITS RELATED THIRD PARTIES. DETAILS OF THIS SERVICE FOR RATINGS FOR WHICH THE LEAD ANALYST IS BASED IN AN EU-REGISTERED ENTITY CAN BE FOUND ON THE ENTITY SUMMARY PAGE FOR THIS ISSUER ON THE FITCH WEBSITE.

Fitch: Puerto Rican Banks Weighed Down by Weak Island Economy

Fitch: Puerto Rican Banks Weighed Down by Weak Island Economy

Tuesday, May 20, 2014

Moody s Is Positive About Proposed Puerto Rico Budget

Moody's said Puerto Rico Gov. García Padilla's proposed budget is a credit positive but that the commonwealth government still has potential challenges.

by Robert Slavin

Moody s Is Positive About Proposed Puerto Rico Budget

by Robert Slavin

Moody s Is Positive About Proposed Puerto Rico Budget

Monday, May 19, 2014

Caribbean Business in 2014

The article “Growth to Accelerate in Latin America and the Caribbean …”, in the Annual World Economic Situation and Prospects 2014 report of the UN Department of Economic and Social Affairs (UNDESA), indicates that Haiti and the Dominican Republic will lead the Caribbean in growth by 2015.

The global competitiveness of both from 2012 to 2013 are recorded in Doing Business 2014 – Regional Profile: Caribbean States, a co-publication of the World Bank and International Financial Corporation, which also records the global competitiveness of eleven other Caribbean islands.

Except for Puerto Rico, all these islands are members of the Caribbean Forum (CARIFORUM); and beside Haiti and the Dominican Republic, all are Small Island Developing States (SIDS). In comparing SIDS to non-SIDS, part 1 of this article indicated that non-SIDS performed worse in Doing Business 2014.

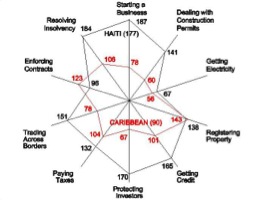

The region was ranked 90, of the 189 nations examined. Ten indicators, across the four stages of the business cycle (i.e. start-up, operation, expansion and insolvency), were evaluated to determine ranks. Figure 1 maps the performance of the Caribbean, and Haiti in particular, across these indicators.

Figure 1: Global Competitiveness Map of the Caribbean

Points closer to the centre indicate better performance. Hence, Haiti which has an overall rank of 177 performed worse in eight of these indicators when compared to the Caribbean region, which has the higher rank. But, it should be noted that performance in each indicator varies about the overall rank.

To improve on overall rank, it stands to reason that the worse indicators need to be addressed as a priority. For the Caribbean, priority indicators starting from the worst seem to be: registering property [143], enforcing contracts [123], resolving insolvency [106], paying taxes [104], and getting credit [102].

As a point of interest, “Getting Credit” is not a priority indicator for Puerto Rico, and Trinidad and Tobago, which have the two highest overall ranks in the Caribbean. Puerto Rico, with the highest overall rank, also has the highest rank in this indicator at 13: followed by Trinidad and Tobago at 28.

When considering only CARIFORUM member states rather than islands of the regional profile, there are marked differences. The priority indicators for the SIDS group do not change, but their order of priority does. For the non-SIDS group, both their priority indicators and order of priority change significantly.

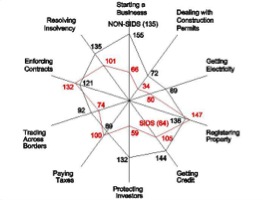

Figure 2 maps the global competitiveness of CARIFORUM SIDS versus non-SIDS. The SIDS group does not include Puerto Rico, and the non-SIDS group includes Guyana, Suriname and Belize – CARIFORUM member states – which were not included in the regional profile.

The overall rank for SIDS is 84. The priority indicators starting from the worst are: registering property [147], enforcing contracts [132], getting credit [105], resolving insolvency [101], and paying taxes [100]. Of note, the ranks of the first three priority indicators are worse than they were for the regional profile.

The overall rank for non-SIDS is 135. In this case, the priority indicators are: starting business [155], getting credit [144], registering property [136], resolving insolvency [135], and protecting investors [132]. “Enforcing Contracts” and “Paying Taxes” are not priority indicators for non-SIDS.

Nevertheless, international assistance is needed to address “Registering Property”, “Enforcing Contracts”, and “Getting Credit”. In the former, Guyana ranked highest at 111. Only Antigua and Barbuda was higher than 81 in the next; and, only Trinidad and Tobago was higher than 86 in the latter.

The importance of “Enforcing Contracts” is self evident: especially when considering foreign direct investment. Which foreign enterprise is going to invest in an unfamiliar location where enforcing contracts is known to be a problem?

However, the significance of “Registering Property” should not be underestimated. According to Peruvian social scientist Hernando DeSoto, eighty per cent of the World is under-capitalized because property owners cannot generate capital from their assets.

Using Haiti as an example, DeSoto stated that the total assets held by its poor amount to over 150 times all foreign investment made in that nation since its independence in 1804. This is particularly alarming when considering that Haiti’s rank in this indicator is better than the average Caribbean state.

But, it is incomprehensible that “Getting Credit” is a priority indicator for SIDS, when so many of these states have developed reputations as international financial centres. Is this due to underdeveloped capital markets, an absence of credit bureaus, or do we not consider local businesses acceptable risks?

The remaining priority indicators can be addressed using the model of the Asia-Pacific Economic Cooperation (APEC). As mentioned in part 1, APEC is a forum committed to the liberalization of trade and investment, business facilitation, and economic and technical cooperation.

According to “APEC: Sharing Goals and Experience” in Doing Business 2013: Smarter Regulations for Small and Medium-Sized Enterprises, APEC’s 2009 action plan has shown “encouraging early results” evident in the marked improvement of their members over non-APEC states.

“APEC sets measurable targets with specific time-lines” to facilitate monitoring and evaluation of performance. One set of targets is based on the “Doing Business” indicators. APEC’s 2009 Doing Business Action Plan sets the target of making business 25 per cent cheaper, faster and easier by 2015.

In addition, “… sustained engagement by top government officials from every APEC member is needed to accelerate progress towards the goals it has set for itself”. APEC also encourages capacity building activities amongst its members to support the attainment of these goals.

Five Doing Business indicators are selected, and the respective “champion economies” are chosen to provide capacity building assistance to the other members. These “champion economies” not only share information and experience, but also undertake personalized diagnostic studies.

“Other regional bodies can learn from this model of capacity building”, and CARIFORUM should follow suit. It has at least three states ranked within the top third in global competitiveness for each of the four remaining priority indicators. So, choosing champion economies should not be a problem.

Belize is the only non-SIDS which could be considered a champion economy in two indicators: “Resolving Insolvency”, for which it ranked 30, and “Paying Taxes”, with a rank of 48. Suriname is the only other non-SIDS champion economy and this is also in “Paying Taxes”, for which it ranked 50.

Coincidentally, “Paying Taxes” is the only indicator which has only two possible SIDS champion economies: Bahamas and St. Lucia. Both ranked 45. Otherwise, champion economies are practically all SIDS, which could affect the efficacy of capacity building assistance to non-SIDS.

There are two priority targets unique to non-SIDS: “Starting Business” and “Protecting Investors”. Addressing “Starting Business” is not likely to be a problem for SIDS champion economies. But, it is suspected that addressing “Protecting Investors” could be.

This indicator has six possible champion economies: all SIDS, and all Anglophone. So, the legal systems of the predominantly non-Anglophone non-SIDS will be totally unfamiliar. Consequently, international assistance may also be required for non-SIDS to address this indicator.

This highlights the problem of dealing with non-SIDS as a unit. Their present amorphous nature especially with regard to language and institutions makes this difficult. Probably when other states with like backgrounds join CARIFORUM, this may be resolved.

In “Doing Business in the Caribbean: Lessons from Singapore”, I benchmarked “Doing Business 2013” ratings of Barbados, Jamaica, and Trinidad and Tobago, in one indicator, against the top ranked Singapore, which is again ranked first in “Doing Business 2014.”

The chosen indicator was “Dealing with Construction Permits”. But, the above indicates that this is not one of CARIFORUM’s priority indicators. In fact, ten possible champion economies could be identified in this indicator: the highest number in any of the priority indicators.

Of the original states benchmarked, only Trinidad and Tobago could not be considered a champion in this indictor. In the 2013 report, they were ranked 101; and in the 2014 report, they were ranked 77: both ranks being below the corresponding non-SIDS rank for the respective years.

Nevertheless, this is a significant improvement in rank. In the 2013 report, this indicator was one of Trinidad and Tobago’s priority indicators. It still is. But, this improvement contributed to Trinidad and Tobago becoming the only CARIFORUM state that has improved its overall rank in the current report.

If CARIFORUM follows their lead, the deterioration of its performance may be halted, or even improved. But, a concerted effort needs to be made to improve the region’s global competitiveness. Otherwise, the growth expected into 2015 will only be short-lived. CARIFORUM needs reform now.

By Paul Hay

Caribbean Business in 2014

The global competitiveness of both from 2012 to 2013 are recorded in Doing Business 2014 – Regional Profile: Caribbean States, a co-publication of the World Bank and International Financial Corporation, which also records the global competitiveness of eleven other Caribbean islands.

Except for Puerto Rico, all these islands are members of the Caribbean Forum (CARIFORUM); and beside Haiti and the Dominican Republic, all are Small Island Developing States (SIDS). In comparing SIDS to non-SIDS, part 1 of this article indicated that non-SIDS performed worse in Doing Business 2014.

The region was ranked 90, of the 189 nations examined. Ten indicators, across the four stages of the business cycle (i.e. start-up, operation, expansion and insolvency), were evaluated to determine ranks. Figure 1 maps the performance of the Caribbean, and Haiti in particular, across these indicators.

Figure 1: Global Competitiveness Map of the Caribbean

Points closer to the centre indicate better performance. Hence, Haiti which has an overall rank of 177 performed worse in eight of these indicators when compared to the Caribbean region, which has the higher rank. But, it should be noted that performance in each indicator varies about the overall rank.

To improve on overall rank, it stands to reason that the worse indicators need to be addressed as a priority. For the Caribbean, priority indicators starting from the worst seem to be: registering property [143], enforcing contracts [123], resolving insolvency [106], paying taxes [104], and getting credit [102].

As a point of interest, “Getting Credit” is not a priority indicator for Puerto Rico, and Trinidad and Tobago, which have the two highest overall ranks in the Caribbean. Puerto Rico, with the highest overall rank, also has the highest rank in this indicator at 13: followed by Trinidad and Tobago at 28.

When considering only CARIFORUM member states rather than islands of the regional profile, there are marked differences. The priority indicators for the SIDS group do not change, but their order of priority does. For the non-SIDS group, both their priority indicators and order of priority change significantly.

Figure 2 maps the global competitiveness of CARIFORUM SIDS versus non-SIDS. The SIDS group does not include Puerto Rico, and the non-SIDS group includes Guyana, Suriname and Belize – CARIFORUM member states – which were not included in the regional profile.

The overall rank for SIDS is 84. The priority indicators starting from the worst are: registering property [147], enforcing contracts [132], getting credit [105], resolving insolvency [101], and paying taxes [100]. Of note, the ranks of the first three priority indicators are worse than they were for the regional profile.

The overall rank for non-SIDS is 135. In this case, the priority indicators are: starting business [155], getting credit [144], registering property [136], resolving insolvency [135], and protecting investors [132]. “Enforcing Contracts” and “Paying Taxes” are not priority indicators for non-SIDS.

Nevertheless, international assistance is needed to address “Registering Property”, “Enforcing Contracts”, and “Getting Credit”. In the former, Guyana ranked highest at 111. Only Antigua and Barbuda was higher than 81 in the next; and, only Trinidad and Tobago was higher than 86 in the latter.

The importance of “Enforcing Contracts” is self evident: especially when considering foreign direct investment. Which foreign enterprise is going to invest in an unfamiliar location where enforcing contracts is known to be a problem?

However, the significance of “Registering Property” should not be underestimated. According to Peruvian social scientist Hernando DeSoto, eighty per cent of the World is under-capitalized because property owners cannot generate capital from their assets.

Using Haiti as an example, DeSoto stated that the total assets held by its poor amount to over 150 times all foreign investment made in that nation since its independence in 1804. This is particularly alarming when considering that Haiti’s rank in this indicator is better than the average Caribbean state.

But, it is incomprehensible that “Getting Credit” is a priority indicator for SIDS, when so many of these states have developed reputations as international financial centres. Is this due to underdeveloped capital markets, an absence of credit bureaus, or do we not consider local businesses acceptable risks?

The remaining priority indicators can be addressed using the model of the Asia-Pacific Economic Cooperation (APEC). As mentioned in part 1, APEC is a forum committed to the liberalization of trade and investment, business facilitation, and economic and technical cooperation.

According to “APEC: Sharing Goals and Experience” in Doing Business 2013: Smarter Regulations for Small and Medium-Sized Enterprises, APEC’s 2009 action plan has shown “encouraging early results” evident in the marked improvement of their members over non-APEC states.

“APEC sets measurable targets with specific time-lines” to facilitate monitoring and evaluation of performance. One set of targets is based on the “Doing Business” indicators. APEC’s 2009 Doing Business Action Plan sets the target of making business 25 per cent cheaper, faster and easier by 2015.

In addition, “… sustained engagement by top government officials from every APEC member is needed to accelerate progress towards the goals it has set for itself”. APEC also encourages capacity building activities amongst its members to support the attainment of these goals.

Five Doing Business indicators are selected, and the respective “champion economies” are chosen to provide capacity building assistance to the other members. These “champion economies” not only share information and experience, but also undertake personalized diagnostic studies.

“Other regional bodies can learn from this model of capacity building”, and CARIFORUM should follow suit. It has at least three states ranked within the top third in global competitiveness for each of the four remaining priority indicators. So, choosing champion economies should not be a problem.

Belize is the only non-SIDS which could be considered a champion economy in two indicators: “Resolving Insolvency”, for which it ranked 30, and “Paying Taxes”, with a rank of 48. Suriname is the only other non-SIDS champion economy and this is also in “Paying Taxes”, for which it ranked 50.

Coincidentally, “Paying Taxes” is the only indicator which has only two possible SIDS champion economies: Bahamas and St. Lucia. Both ranked 45. Otherwise, champion economies are practically all SIDS, which could affect the efficacy of capacity building assistance to non-SIDS.

There are two priority targets unique to non-SIDS: “Starting Business” and “Protecting Investors”. Addressing “Starting Business” is not likely to be a problem for SIDS champion economies. But, it is suspected that addressing “Protecting Investors” could be.

This indicator has six possible champion economies: all SIDS, and all Anglophone. So, the legal systems of the predominantly non-Anglophone non-SIDS will be totally unfamiliar. Consequently, international assistance may also be required for non-SIDS to address this indicator.

This highlights the problem of dealing with non-SIDS as a unit. Their present amorphous nature especially with regard to language and institutions makes this difficult. Probably when other states with like backgrounds join CARIFORUM, this may be resolved.

In “Doing Business in the Caribbean: Lessons from Singapore”, I benchmarked “Doing Business 2013” ratings of Barbados, Jamaica, and Trinidad and Tobago, in one indicator, against the top ranked Singapore, which is again ranked first in “Doing Business 2014.”

The chosen indicator was “Dealing with Construction Permits”. But, the above indicates that this is not one of CARIFORUM’s priority indicators. In fact, ten possible champion economies could be identified in this indicator: the highest number in any of the priority indicators.

Of the original states benchmarked, only Trinidad and Tobago could not be considered a champion in this indictor. In the 2013 report, they were ranked 101; and in the 2014 report, they were ranked 77: both ranks being below the corresponding non-SIDS rank for the respective years.

Nevertheless, this is a significant improvement in rank. In the 2013 report, this indicator was one of Trinidad and Tobago’s priority indicators. It still is. But, this improvement contributed to Trinidad and Tobago becoming the only CARIFORUM state that has improved its overall rank in the current report.

If CARIFORUM follows their lead, the deterioration of its performance may be halted, or even improved. But, a concerted effort needs to be made to improve the region’s global competitiveness. Otherwise, the growth expected into 2015 will only be short-lived. CARIFORUM needs reform now.

By Paul Hay

Caribbean Business in 2014

Saturday, May 17, 2014

Puerto Rico Rebuffs Doral s Demands for $230M Refund

Doral Financial (DRL) is evaluating its legal options after Puerto Rico rejected the company's request for a $230 million refund of overpaid taxes.

by Paul Davis

Puerto Rico Rebuffs Doral s Demands for $230M Refund - American Banker Article

by Paul Davis

Puerto Rico Rebuffs Doral s Demands for $230M Refund - American Banker Article

Puerto Rico: Balanced-Budget Double Talk Can't Blind People to Dismal Reality

In March of this year, Puerto Rico Governor Alejandro García Padilla delivered his State of the Commonwealth speech, promising a balanced budget and no more borrowing. At first glance this sounded like a bold step. With some US$70 billion in debt, Puerto Rico has been financing budget deficits for decades under the leadership of both major political parties.

Something about the announcement, however, didn’t quite add up. That’s not to say balancing the budget and putting an end to borrowing is a bad thing; it is exactly the right thing to do. So what is wrong with this picture?

Earlier this year the commonwealth issued about $3.5 billion in bonds as a form of gap financing to help the government meet its obligations for the next few years as the economy recovered. Controlling spending and boosting the local economy are part of that overall plan to get the island back to some semblance of economic sanity.

While the objective is good, there is one question unanswered: is the island really going to balance the budget with no new borrowing, or did they just balance it with $3.5 billion in bonds so they could say they won’t borrow money next year?

Now comes a report that the commonwealth will issue another $500 million in bonds next year.

Wait … what?

If Puerto Rico issued $3.5 billion for gap funding to get over the borrowing hump, why do they need an extra $500 million next year? In fairness, the new bond issue is being sold as a way to refinance some municipal debt; however, it is also expected to help finance new public projects. In other words it is, at least in part, financing deficit spending.

I’m not the only one doubting the promise of no more borrowing, and there is already backlash over earlier bonds and losses. Reuters “Muniland,” for example, remains bearish on Puerto Rico. Referencing Jim Grant of Grant’s Interest Rate Observer, they write that “given the commonwealth’s population decline and low labor participation rate of around 40 percent, he is unable to discern any long-term plan to right size the government’s debt load.” Meanwhile, some investors are suing UBS over risky PR bond funds.

The governor’s insistence that Puerto Rico is not Detroit or Greece are of little comfort when one considers the double talk on balanced budgets and debt sales. Pessimism continues to reign supreme in the non-political circles, as exemplified by this article in GuruFocus.

Meanwhile, Doral Financial announced that they will be revising their capital plan. Under orders from the FDIC, the troubled PR bank may no longer include some of or all the tax receivables from the government of Puerto Rico in its calculation of its Tier 1 capital. That money represented nearly half of the bank’s Tier 1 capital. The report says of the decision: “[leaves] Doral out of compliance with its Consent Order with FDIC because it will no longer be able to accept or roll over brokered deposits, which means they could lose about 18 percent of their deposit base.”

Doral Financial’s woes are the tip of the Puerto Rico economic-disaster iceberg. Gurufocus.com notes that Doral’s financial difficulties could spread to other banks on the island, and some of those other banks are already in trouble.

Doral maintains that the tax receivables could be included properly in the revised plan and is working with the FDIC to do so, while also seeking to raise capital and consider the sale of some assets. Beyond what is appropriate or not within the interminable maze of government banking regulation, is it possible that the FDIC knows something about potential future tax receivables revenue that the Puerto Rico government isn’t saying? If long term tax revenue is in doubt, how will Puerto Rico maintain its promise of a balanced budget? It can’t.

The islands economy continues to shrink although the pace has slowed. The island’s economy shrank at an annual rate of 0.8 percent in March, compared to 2.5 percent in the previous month. However, the economy had an accumulated drop of 3.4 percent from July 2013 to March 2014.

Still, there are those who see a brighter future for the island. Billionaire John Paulson plans to invest a billion dollars betting on the island’s recovery. Paulson’s optimism, however, appears wrongly placed given the financial situation in the United States. Puerto Rico is not (as they say) an island unto itself, when it comes to its economic future. As a US territory it goes where United States goes, which is nowhere fast. Newly appointed Chair of the Federal Reserve Janet Yellen says “under current politics the federal government’s deficits will rise to unsustainable levels.” The United States will add another $7.5 trillion in new debt in the next six years.

In addition, in what may at first glance be a good story, the US unemployment rate fell to 6.3 percent as the economy gained about 288,000 new jobs. Once again, however, the devil is in the details. The number actually fell because people who have stopped or given up looking for a job are no longer counted. The number of people who gave up rose sharply, 800,000 last month alone. A staggering 92 million US Americans are not working.

So what happens to the United States and by default Puerto Rico when those debts and all of that unemployment come home to roost in the form of an economic downturn of biblical proportions?

If there is any bright spot in the future of Puerto Rico’s economy, it is that things are so bad that the legislature is finally putting all options on the table. Included in those options are the legalization of marijuana and prostitution, two Ideas I have long advocated.

Author’s note: a summary of the Governor’s budget proposal may be found here.

Frank Worley-Lopez

Puerto Rico: Balanced-Budget Double Talk Can't Blind People to Dismal Reality

Something about the announcement, however, didn’t quite add up. That’s not to say balancing the budget and putting an end to borrowing is a bad thing; it is exactly the right thing to do. So what is wrong with this picture?

Earlier this year the commonwealth issued about $3.5 billion in bonds as a form of gap financing to help the government meet its obligations for the next few years as the economy recovered. Controlling spending and boosting the local economy are part of that overall plan to get the island back to some semblance of economic sanity.

While the objective is good, there is one question unanswered: is the island really going to balance the budget with no new borrowing, or did they just balance it with $3.5 billion in bonds so they could say they won’t borrow money next year?

Now comes a report that the commonwealth will issue another $500 million in bonds next year.

Wait … what?

If Puerto Rico issued $3.5 billion for gap funding to get over the borrowing hump, why do they need an extra $500 million next year? In fairness, the new bond issue is being sold as a way to refinance some municipal debt; however, it is also expected to help finance new public projects. In other words it is, at least in part, financing deficit spending.

I’m not the only one doubting the promise of no more borrowing, and there is already backlash over earlier bonds and losses. Reuters “Muniland,” for example, remains bearish on Puerto Rico. Referencing Jim Grant of Grant’s Interest Rate Observer, they write that “given the commonwealth’s population decline and low labor participation rate of around 40 percent, he is unable to discern any long-term plan to right size the government’s debt load.” Meanwhile, some investors are suing UBS over risky PR bond funds.

The governor’s insistence that Puerto Rico is not Detroit or Greece are of little comfort when one considers the double talk on balanced budgets and debt sales. Pessimism continues to reign supreme in the non-political circles, as exemplified by this article in GuruFocus.

Meanwhile, Doral Financial announced that they will be revising their capital plan. Under orders from the FDIC, the troubled PR bank may no longer include some of or all the tax receivables from the government of Puerto Rico in its calculation of its Tier 1 capital. That money represented nearly half of the bank’s Tier 1 capital. The report says of the decision: “[leaves] Doral out of compliance with its Consent Order with FDIC because it will no longer be able to accept or roll over brokered deposits, which means they could lose about 18 percent of their deposit base.”

Doral Financial’s woes are the tip of the Puerto Rico economic-disaster iceberg. Gurufocus.com notes that Doral’s financial difficulties could spread to other banks on the island, and some of those other banks are already in trouble.

Doral maintains that the tax receivables could be included properly in the revised plan and is working with the FDIC to do so, while also seeking to raise capital and consider the sale of some assets. Beyond what is appropriate or not within the interminable maze of government banking regulation, is it possible that the FDIC knows something about potential future tax receivables revenue that the Puerto Rico government isn’t saying? If long term tax revenue is in doubt, how will Puerto Rico maintain its promise of a balanced budget? It can’t.

The islands economy continues to shrink although the pace has slowed. The island’s economy shrank at an annual rate of 0.8 percent in March, compared to 2.5 percent in the previous month. However, the economy had an accumulated drop of 3.4 percent from July 2013 to March 2014.

Still, there are those who see a brighter future for the island. Billionaire John Paulson plans to invest a billion dollars betting on the island’s recovery. Paulson’s optimism, however, appears wrongly placed given the financial situation in the United States. Puerto Rico is not (as they say) an island unto itself, when it comes to its economic future. As a US territory it goes where United States goes, which is nowhere fast. Newly appointed Chair of the Federal Reserve Janet Yellen says “under current politics the federal government’s deficits will rise to unsustainable levels.” The United States will add another $7.5 trillion in new debt in the next six years.

In addition, in what may at first glance be a good story, the US unemployment rate fell to 6.3 percent as the economy gained about 288,000 new jobs. Once again, however, the devil is in the details. The number actually fell because people who have stopped or given up looking for a job are no longer counted. The number of people who gave up rose sharply, 800,000 last month alone. A staggering 92 million US Americans are not working.

So what happens to the United States and by default Puerto Rico when those debts and all of that unemployment come home to roost in the form of an economic downturn of biblical proportions?

If there is any bright spot in the future of Puerto Rico’s economy, it is that things are so bad that the legislature is finally putting all options on the table. Included in those options are the legalization of marijuana and prostitution, two Ideas I have long advocated.

Author’s note: a summary of the Governor’s budget proposal may be found here.

Frank Worley-Lopez

Puerto Rico: Balanced-Budget Double Talk Can't Blind People to Dismal Reality

Thursday, May 15, 2014

Puerto Rico Branch 57th Annual Meeting June 2014

Puerto Rico Society of Microbiologists (PRSM)

(Puerto Rico Branch of American Society for Microbiology)

57th Annual Meeting -

Microbiology on the 21st Century: Microbiomes and Omics

Date: June 19-20, 2014

Place: Hotel Verdanza – Isla Verde, PR

Meeting Program and Registration Information: Click Here for Meeting Program

Branch and Meeting Website: www.micropr.org

For more information, contact

Robur Otero, PRSM President

787-380-2679

787-610-3775

Puerto Rico Branch 57th Annual Meeting June 2014

Krispy Kreme to open 600th international store in Carolina, Puerto Rico

Given its North Carolina roots, it seems pretty fitting that Krispy Kreme Doughnuts Inc. is opening its 600th international store in Carolina.

That's Carolina, Puerto Rico.

The Winston-Salem-based company (NYSE: KKD) announced Wednesday that the store will open Saturday.

It will be operated by its Puerto Rico-based franchise partner, Caribbean Glaze Corp. Caribbean Glaze opened its first Krispy Kreme location in 2008 in Caguas, Puerto Rico, and has five additional stores on the island.

“We are excited to see our international franchise business growing through deeper relationships with our franchise partners," said Dan Beem, Krispy Kreme's President of International. "All are signs of a bright future for our brand and our global partners.”

Krispy Kreme, which is in the midst of an ambitious domestic and international growth plan, now has more than 800 retail shops in more than 20 countries in North America, Latin America, the Asia/Pacific region, the Middle East and Europe.

The company aims to have 900 international franchises by fiscal 2017.

Amy Dominello Braun

Krispy Kreme to open 600th international store in Carolina, Puerto Rico

That's Carolina, Puerto Rico.

The Winston-Salem-based company (NYSE: KKD) announced Wednesday that the store will open Saturday.

It will be operated by its Puerto Rico-based franchise partner, Caribbean Glaze Corp. Caribbean Glaze opened its first Krispy Kreme location in 2008 in Caguas, Puerto Rico, and has five additional stores on the island.