The global competitiveness of both from 2012 to 2013 are recorded in Doing Business 2014 – Regional Profile: Caribbean States, a co-publication of the World Bank and International Financial Corporation, which also records the global competitiveness of eleven other Caribbean islands.

Except for Puerto Rico, all these islands are members of the Caribbean Forum (CARIFORUM); and beside Haiti and the Dominican Republic, all are Small Island Developing States (SIDS). In comparing SIDS to non-SIDS, part 1 of this article indicated that non-SIDS performed worse in Doing Business 2014.

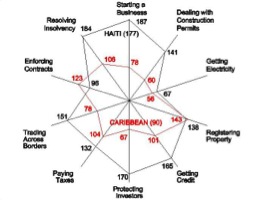

The region was ranked 90, of the 189 nations examined. Ten indicators, across the four stages of the business cycle (i.e. start-up, operation, expansion and insolvency), were evaluated to determine ranks. Figure 1 maps the performance of the Caribbean, and Haiti in particular, across these indicators.

Figure 1: Global Competitiveness Map of the Caribbean

Points closer to the centre indicate better performance. Hence, Haiti which has an overall rank of 177 performed worse in eight of these indicators when compared to the Caribbean region, which has the higher rank. But, it should be noted that performance in each indicator varies about the overall rank.

To improve on overall rank, it stands to reason that the worse indicators need to be addressed as a priority. For the Caribbean, priority indicators starting from the worst seem to be: registering property [143], enforcing contracts [123], resolving insolvency [106], paying taxes [104], and getting credit [102].

As a point of interest, “Getting Credit” is not a priority indicator for Puerto Rico, and Trinidad and Tobago, which have the two highest overall ranks in the Caribbean. Puerto Rico, with the highest overall rank, also has the highest rank in this indicator at 13: followed by Trinidad and Tobago at 28.

When considering only CARIFORUM member states rather than islands of the regional profile, there are marked differences. The priority indicators for the SIDS group do not change, but their order of priority does. For the non-SIDS group, both their priority indicators and order of priority change significantly.

Figure 2 maps the global competitiveness of CARIFORUM SIDS versus non-SIDS. The SIDS group does not include Puerto Rico, and the non-SIDS group includes Guyana, Suriname and Belize – CARIFORUM member states – which were not included in the regional profile.

The overall rank for SIDS is 84. The priority indicators starting from the worst are: registering property [147], enforcing contracts [132], getting credit [105], resolving insolvency [101], and paying taxes [100]. Of note, the ranks of the first three priority indicators are worse than they were for the regional profile.

The overall rank for non-SIDS is 135. In this case, the priority indicators are: starting business [155], getting credit [144], registering property [136], resolving insolvency [135], and protecting investors [132]. “Enforcing Contracts” and “Paying Taxes” are not priority indicators for non-SIDS.

Nevertheless, international assistance is needed to address “Registering Property”, “Enforcing Contracts”, and “Getting Credit”. In the former, Guyana ranked highest at 111. Only Antigua and Barbuda was higher than 81 in the next; and, only Trinidad and Tobago was higher than 86 in the latter.

The importance of “Enforcing Contracts” is self evident: especially when considering foreign direct investment. Which foreign enterprise is going to invest in an unfamiliar location where enforcing contracts is known to be a problem?

However, the significance of “Registering Property” should not be underestimated. According to Peruvian social scientist Hernando DeSoto, eighty per cent of the World is under-capitalized because property owners cannot generate capital from their assets.

Using Haiti as an example, DeSoto stated that the total assets held by its poor amount to over 150 times all foreign investment made in that nation since its independence in 1804. This is particularly alarming when considering that Haiti’s rank in this indicator is better than the average Caribbean state.

But, it is incomprehensible that “Getting Credit” is a priority indicator for SIDS, when so many of these states have developed reputations as international financial centres. Is this due to underdeveloped capital markets, an absence of credit bureaus, or do we not consider local businesses acceptable risks?

The remaining priority indicators can be addressed using the model of the Asia-Pacific Economic Cooperation (APEC). As mentioned in part 1, APEC is a forum committed to the liberalization of trade and investment, business facilitation, and economic and technical cooperation.

According to “APEC: Sharing Goals and Experience” in Doing Business 2013: Smarter Regulations for Small and Medium-Sized Enterprises, APEC’s 2009 action plan has shown “encouraging early results” evident in the marked improvement of their members over non-APEC states.

“APEC sets measurable targets with specific time-lines” to facilitate monitoring and evaluation of performance. One set of targets is based on the “Doing Business” indicators. APEC’s 2009 Doing Business Action Plan sets the target of making business 25 per cent cheaper, faster and easier by 2015.

In addition, “… sustained engagement by top government officials from every APEC member is needed to accelerate progress towards the goals it has set for itself”. APEC also encourages capacity building activities amongst its members to support the attainment of these goals.

Five Doing Business indicators are selected, and the respective “champion economies” are chosen to provide capacity building assistance to the other members. These “champion economies” not only share information and experience, but also undertake personalized diagnostic studies.

“Other regional bodies can learn from this model of capacity building”, and CARIFORUM should follow suit. It has at least three states ranked within the top third in global competitiveness for each of the four remaining priority indicators. So, choosing champion economies should not be a problem.

Belize is the only non-SIDS which could be considered a champion economy in two indicators: “Resolving Insolvency”, for which it ranked 30, and “Paying Taxes”, with a rank of 48. Suriname is the only other non-SIDS champion economy and this is also in “Paying Taxes”, for which it ranked 50.

Coincidentally, “Paying Taxes” is the only indicator which has only two possible SIDS champion economies: Bahamas and St. Lucia. Both ranked 45. Otherwise, champion economies are practically all SIDS, which could affect the efficacy of capacity building assistance to non-SIDS.

There are two priority targets unique to non-SIDS: “Starting Business” and “Protecting Investors”. Addressing “Starting Business” is not likely to be a problem for SIDS champion economies. But, it is suspected that addressing “Protecting Investors” could be.

This indicator has six possible champion economies: all SIDS, and all Anglophone. So, the legal systems of the predominantly non-Anglophone non-SIDS will be totally unfamiliar. Consequently, international assistance may also be required for non-SIDS to address this indicator.

This highlights the problem of dealing with non-SIDS as a unit. Their present amorphous nature especially with regard to language and institutions makes this difficult. Probably when other states with like backgrounds join CARIFORUM, this may be resolved.

In “Doing Business in the Caribbean: Lessons from Singapore”, I benchmarked “Doing Business 2013” ratings of Barbados, Jamaica, and Trinidad and Tobago, in one indicator, against the top ranked Singapore, which is again ranked first in “Doing Business 2014.”

The chosen indicator was “Dealing with Construction Permits”. But, the above indicates that this is not one of CARIFORUM’s priority indicators. In fact, ten possible champion economies could be identified in this indicator: the highest number in any of the priority indicators.

Of the original states benchmarked, only Trinidad and Tobago could not be considered a champion in this indictor. In the 2013 report, they were ranked 101; and in the 2014 report, they were ranked 77: both ranks being below the corresponding non-SIDS rank for the respective years.

Nevertheless, this is a significant improvement in rank. In the 2013 report, this indicator was one of Trinidad and Tobago’s priority indicators. It still is. But, this improvement contributed to Trinidad and Tobago becoming the only CARIFORUM state that has improved its overall rank in the current report.

If CARIFORUM follows their lead, the deterioration of its performance may be halted, or even improved. But, a concerted effort needs to be made to improve the region’s global competitiveness. Otherwise, the growth expected into 2015 will only be short-lived. CARIFORUM needs reform now.

By Paul Hay

Caribbean Business in 2014

No comments:

Post a Comment