Guam, the U.S. territory in the Pacific more than 9,000 miles (14,480 kilometers) from Puerto Rico, is giving municipal bond investors stung by the Caribbean island’s record default a reason to pause.

The 30-mile-long tropical island is selling $245.5 million of limited-obligation bonds Thursday to refinance older, higher-yielding debt and to help fund improvements at the territory’s public hospital. The securities, which are backed by revenue derived from federal income taxes collected on the island, carry an investment grade rating of BBB+ from S&P Global Ratings, five steps above the junk rating of BB- on Guam’s general-obligations.

The limited-obligation debt, referred to as Section 30 bonds, stands to benefit from U.S. plans to expand its military operations on the island of about 165,000, which is the closest U.S. territory to potential hot spots in Asia. The U.S. is looking to double the size of its presence as it seeks to diminish its footprint on the Japanese island of Okinawa.

S&P kept its outlook on Guam unchanged following the passage of what’s known as Promesa, the law enacted by President Barack Obama on June 30 to help Puerto Rico restructure its debt through a federal oversight board. The same approach could be extended to other territories beyond Puerto Rico based on the law, an idea that both Guam and the U.S. Virgin Islands have repeatedly rejected.

"It’s the credit fundamentals that speak to the ability of a government to pay its debt in full and on time, not lingering or potential legislation," said S&P analyst Paul Dyson. "Relative to Puerto Rico, they’re doing a lot better."

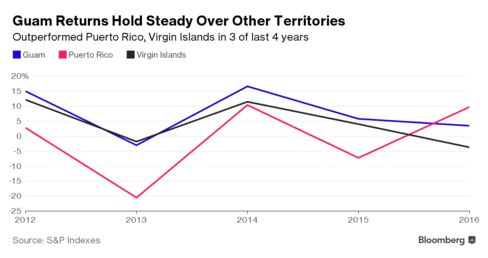

With an active military presence of about six thousand personnel already stationed on the island, Guam’s financial resume reads a bit differently than its Caribbean territory counterparts of Puerto Rico and the U.S. Virgin Islands, both of which have been plagued with debt amid population declines and chronic budget deficits. Guam’s $1.1 billion of debt, issued by various arms of the government, amounts to some $6,000 per person; far less than Puerto Rico’s $20,000 and the Virgin Islands’ $23,000. Guam has posted eight consecutive years of economic growth through 2014, according to the Bureau of Economic Analysis, as well as an expanding population, which could increase even more as military personnel and their families spill over from Japan.

Guam’s bonds maturing in 2039 have rallied over the past year, coming off of a peak yield of 4.15 percent in September. They last traded at an average yield of 3.24 percent, or 1.81 percentage points above benchmark securities, data compiled by Bloomberg show. For some investors, though, that yield premium isn’t enough, as Promesa still creates some pressure for the territory.

"It may or may not be enough at the moment," said David Ashley, a Santa Fe, New Mexico-based portfolio manager at Thornburg Investment Management, which holds some Guam Section 30 debt among its $12 billion in munis. "There should be more of a risk premium on Guam."

Territory officials have been meeting with investors in the U.S. ahead of the sale to quell concerns. Jay Rojas, administrator of the Guam Economic Development Authority, said that they are delivering the message that Guam’s economic outlook is strong and just because Promesa passed, the Pacific territory shouldn’t be viewed negatively.

"Guam’s story is good," Rojas said. "We are unique, we are different, we are alive."

Talks of the military relocation started back in 2006, when territory officials estimated that the move could bring in as much as some 19,000 people between the Marines, their dependents, and other government workers. That projection has since been scaled back several times, with Rojas now estimating an increase of 7,000 to 9,000 by 2028 once the 13-year, $8.7 billion project is complete.

"We’re not speculating," said Ted Chapman, another analyst for S&P. "The final impact and deadline is just potentially a moving target."

Molly SmithGuam Downplays Puerto Rico Risk Amid Return to Municipal Market

No comments:

Post a Comment