The fate of the prototype for Puerto Rico’s debt-restructuring effort hinges on winning an investment-grade credit rating on new bonds investors have agreed to accept in exchange for providing relief to the island’s main electric utility.

While that may appear to be an arduous task for an agency already in technical default, it may not matter in the long run, according to two people involved with the negotiations who declined to be identified because the talks are private. After two years of negotiations, creditors have too much at stake to let the Puerto Rico Electric Power Authority’s $9 billion restructuring unravel, they said.

What’s giving investors comfort is the structure of the new securities, which will be repaid with dedicated revenue that the agency known as Prepa doesn’t have access to and flows straight to the bond trustee. The island’s electricity commission approved in June a 3.10 cent per kilowatt hour surcharge that will go toward repaying the bonds.

“You have to be able to trust that the revenue stream is protected and it can’t be taken away and manipulated,” said Daniel Solender, head of municipals in Jersey City, New Jersey, for Lord Abbett & Co., which manages $20 billion of state and local debt, including Prepa bonds. “If that type of structure can be set up, than a lot of things are possible.”

Restructuring Template

In what would be the largest restructuring in the $3.7 trillion municipal-bond market, creditors holding about 70 percent of Prepa debt agreed in December to accept 85 cents on the dollar for the securities. Analysts have pointed to the agreement as a road map for future debt talks once the financial control board being set up for the island by the U.S. takes effect later this year.

A junk rating doesn’t necessarily prohibit Prepa from restructuring, said Matt Fabian, a partner at Concord, Massachusetts-based Municipal Market Analytics. The utility would need to amend its creditor agreement, he said.

“Creditors still want to exit and a non-investment grade rating means that the economics are a little bit worse for everyone, but in the absence of any other good ideas, this is all they have,” Fabian said.

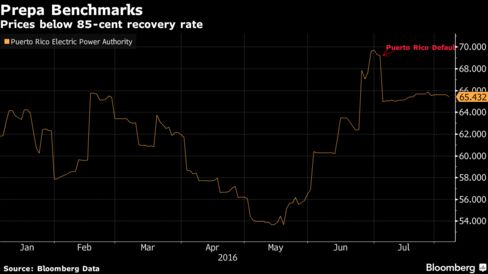

Prices of the existing securities suggest investors remain wary. Bonds maturing in July 2040, the agency’s most-actively traded security in the past three months, changed hands Aug. 5 at an average price of 65 cents on the dollar, 20 cents below the recovery rate, data compiled by Bloomberg show.

It’s unlikely that Prepa will receive an investment-grade rating after the commonwealth defaulted in July and August on general-obligation debt that was guaranteed by its constitution, said Dick Larkin, director of credit analysis at Stoever Glass & Co., who spent nearly 26 years assigning municipal credit ratings at S&P Global Ratings and Fitch Ratings.

“I don’t believe any kind of a securitized deal coming out of Puerto Rico can get an investment grade when the sponsor itself is breaking constitutional law,” Larkin said.

S&P has already told Prepa that its restructuring, as of now, wouldn’t garner an investment grade, Caribbean Business reported, quoting Carlos Gallisa, a utility board member who represents residential customers. Prepa said in response that it hasn’t started the formal rating process yet.

Rating Process

“While the outcome of the rating process cannot be predicted at this stage, Prepa maintains that there is a path to obtaining an investment grade rating for the securitization bonds and intends to continue working diligently and collaboratively together with its creditors and other stakeholders to implement the deal agreed as part of the restructuring support agreement,” Lisa Donahue, Prepa’s chief restructuring officer, said in a statement. “Prepa intends to start engaging with Moody’s and also start the formal process with S&P in the near future.”

“We continue to have strong confidence that the securitization bonds are well-positioned to receive an investment-grade rating,” Stephen Spencer, managing director at Houlihan Lokey, adviser to a group of Prepa bondholders, said in a statement.

Getting investors to trust that it won’t default on the new bonds no matter what the rating is still a challenge. Hedge funds and insurance companies are already suingPuerto Rico and its agencies over a local debt-moratorium law and for redirecting certain revenue that the creditors say go against commonwealth or federal laws. That’s even after the federal legislation authorizing the island’s overall debt restructuring included a stay on litigation.

Upgrade Potential

Investors also face the risk that the electricity surcharge may not be enough with a declining population and if customers fail to pay bills on time, Fabian said. Overdue accounts totaled $1.8 billion as of May, the bulk of that from government entities, according to the utility’s website.

Prepa and its creditors have been negotiating since August 2014 on how to improve the utility’s finances after it raided reserve funds to pay for fuel. Creditors agreed to accept losses and wait longer to be repaid to enable the utility to rehabilitate a system that relies on oil to produce electricity. The goal is for Prepa’s operating costs to decrease over time so that it can repay its obligations. That’s a risk that investors appear to be willing to take whether the new debt is rated investment grade or not.

“This is a financing that’s not impossible, and could season itself into an investment-grade security,” Fabian said.

Michelle KaskePuerto Rico’s Record Restructuring Seen Surviving Junk Rating

No comments:

Post a Comment