However, the proposal to increase the import tax by 68 percent is yet to receive sufficient votes in the Senate and Chamber of Representatives of the island

To secure the extra income, which will help lift a range of public institutions out of bankruptcy, the governor held a meeting with the president of the Senate, Eduardo Bhatia, and the president of the Chamber of Representatives, Jaime Perelló.

In the meeting, they agreed to the changes contained within the governor’s proposals, and to the Highways and Transportation Authority (ACT), one of the agencies of the Department of Transport and Public Works (DTOP) which finds itself in difficulties.

It’s essential for Padilla that the change is approved before the end of November. Otherwise, the Urban Train and the DTOP’s Metropolitan Bus Authority (AMA) services will remain paralyzed due to lack of resources.

After the meeting, Bhatia commented that the budget for these departments will need to be evaluated, along with the best way to provide funding for these transportation services. For his part, Perelló said that the proposal as currently configured won’t secure enough votes to pass the Chamber of Representatives.

When the new draft of the bill is ready, García Padilla will convene an extraordinary legislative session to submit the proposal to a vote, complete with the modifications sought by the legislature’s representatives.

Highway System Faces Financial Difficulty

The objective of this increase — nicknamed la crudita — is to create a special fund of almost $178 million available annually to cover the costs of ACT operations. It will furthermore enable the ACT to comply with the hefty credit obligations it has with the Government Development Bank (BGF), which are affecting the bank’s liquidity.The plan is to transfer the debt of the ACT to the Authority of the Financing of Infrastructure (AFI), a government department that would in turn issue between $2,500 and $2,900 in public bonds to pay the BGF’s debt. The idea is to transfer ownership of the debt from the bank to those investors who buy the bonds.

For lawyer and local political analyst Luis Dávila Colón, the increase in the petroleum import tax shouldn’t be seen as an isolated act, but rather as part of a series of actions by the government that will directly hit the wallets of Puerto Ricans.

With these changes, the state is looking to burden the consumer with a $1.5 billion debt.“The government is carrying out these reforms not out of genuine necessity, but rather out of foolishness. Puerto Rico’s problem is not a lack of money, but excessive spending. Each year the national budget rises by 15 percent. Instead of cutting expenditure, the government boosts it.”

Puerto Rico Moves Towards Tax Reform

Puerto Rico Government Secretary Víctor Suárez, who was present at the meeting concerning the proposals, explained that the Executive is to present the general outlines and a date for discussion for tax reform prior to March 2015, in order to be put in practice in April 2016.“It’s a new tax system, a very complex law code which tackles necessary aspects, such as the income of municipal authorities and procedural matters,” said Suárez.

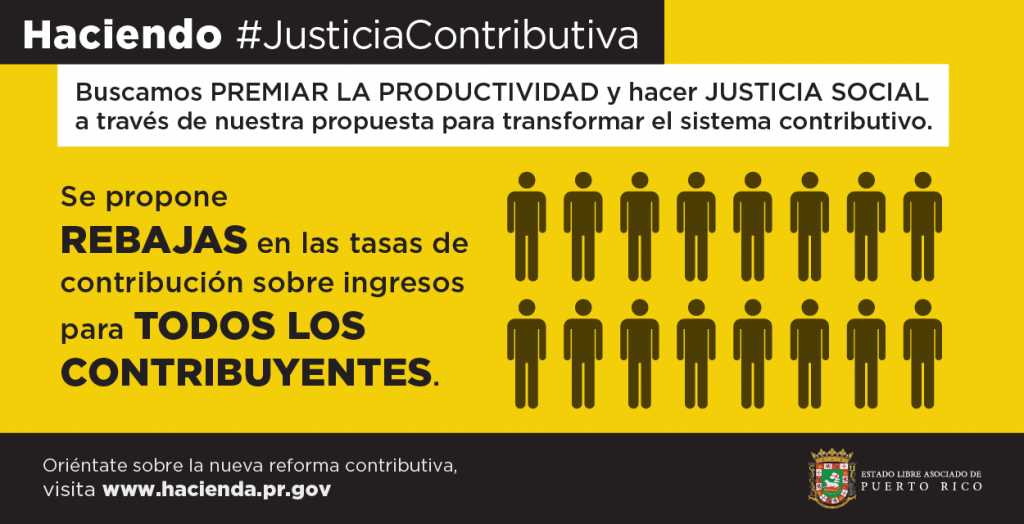

Official publicity concerning forthcoming tax reform in Puerto Rico. (La Fortaleza de PR)

Among the principal modifications are a new Internal Revenue Code that replaces the Sales and Use Tax (IVU) with Value-Added Tax (IVA). This will be a tax applied to all goods and services that are consumed on the island, but with different rates according to each item.

“The substitution of the IVU for IVA means an increase in expenditure in each phase of production. Currently IVU is at 7 percent, but with the IVA the tax will be between 12 percent and 21 percent of the costs of production,” said Colón.

Another proposal within the tax reform is that companies pay a capital gains tax at the same percentage as individuals do on their income — currently a maximum of 30 percent.

These tax changes are being introduced after 20 years of economic recession, and when the island faces an external debt of more than $73 billion, unemployment higher than 14 percent, and as a potential reform to electricity tariffs could increase the economic pressure even further.

Puerto Rico Resorts to Gas Tax amid Crippling Debt

No comments:

Post a Comment