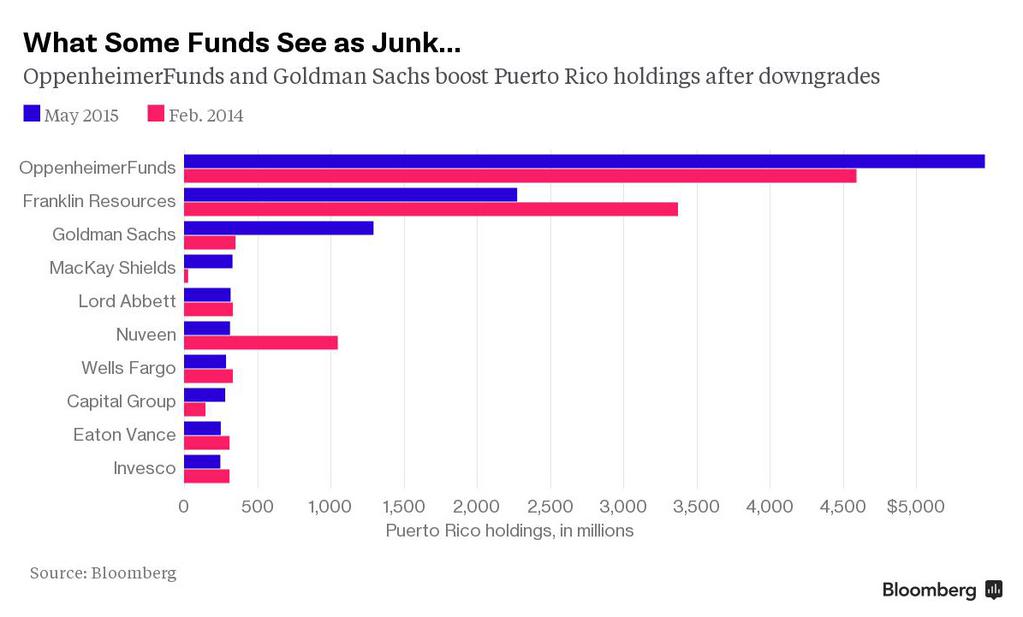

Goldman Sachs increased its stake in Puerto Rico bonds to $1.3 billion as of May 5 from $351 million in February 2014, when the island was cut to speculative grade, according to data compiled by Bloomberg. OppenheimerFunds has snapped up sales-tax backed debt since the downgrade.

The two are bucking the trend among the 10 largest mutual-fund holders of Puerto Rico bonds by increasing their stakes as yields on some securities have climbed to 10 percent. That’s the equivalent of almost 18 percent for top earners when factoring in the tax exemption. Those payouts are alluring with municipal-bond yields holding near a five-decade low.

Too Speculative

The split among the mutual funds highlights how Puerto Rico debt has increasingly become too speculative for many municipal-bond buyers, who seek tax-free income, not the outsized returns chased by hedge funds.OppenheimerFunds’s increased stake keeps it the biggest mutual-fund owner of Puerto Rico bonds. The push from Goldman Sachs elevated the company’s rank to third from eighth since February 2014. Franklin Resources Inc.’s holdings have declined by more than $1 billion since then, though it’s still the second-biggest owner.

The jump in Goldman’s investment began with the commonwealth’s record junk deal in March 2014 and kept going as it more than tripled its ownership of the securities. The buying was led by its Strategic Income Fund, which invests in global bonds and uses derivatives to bet that asset prices will fall.

New York-based OppenheimerFunds has made Puerto Rico a core holding for years because it’s tax-free nationwide. The company’s position in sales-tax bonds, known as Cofinas, increased to $325 million by the end of 2014, up from $40.6 million earlier in the year, Bloomberg data show. The securities, which don’t mature until 2057 and aren’t insured, trade at about 65 cents on the dollar.

Insurance Split

Andrew Williams, a spokesman for Goldman Sachs in New York, declined to comment on the holdings, as did Ray Pellecchia, a spokesman for OppenheimerFunds. Stacey Johnston Coleman, a spokeswoman for San Mateo, California-based Franklin, also declined to comment.Puerto Rico and its public agencies are struggling with $72 billion of debt and a sluggish economy. Bond prices have been trading at distressed levels for more than a year on speculation the island won’t be able to pay all investors.

Last week, its House of Representatives passed a tax plan that may help the commonwealth balance the fiscal 2016 budget. That pushed Puerto Rico’s newest general-obligation bonds to a two-month high. The Senate passed an amended version Monday, sending it back to the House.

OppenheimerFunds created a “Puerto Rico Roundup” part of its website and said its shareholders “may want to bookmark” it. The most-recent commentary on May 20 said elected officials usually “know better than to contemplate compromises related to their full and timely payments on general obligation debt.”

Different Roadmaps

MacKay Shields and Capital Group Cos., the fourth- and eighth-biggest holders, respectively, have expanded their ownership by largely buying insured debt. They weren’t in the top 10 when the island lost its investment-grade rank.Nuveen Asset Management, which oversees more than $100 billion in munis, has been paring its position: It was the third-largest holder of Puerto Rico bonds in February 2014. It now ranks sixth.

“The lack of a roadmap for how you get to recovery, and what that recovery might be, is one of the hardest things to figure out right now,” said John Miller, co-head of fixed income in Chicago at Nuveen. “We’d want to have a better sense of that before committing capital.”

Eaton Vance Management, at ninth, has about 95 percent of holdings backed by insurers, said Craig Brandon, who helps oversee the company’s $28.6 billion in munis.

‘No Referee’

“There came a point where we were uncomfortable with each credit on an individual basis,” Brandon said. “Without Chapter 9, you’re playing the game with no referee -- anything can happen out there.”Unlike U.S. local governments, Puerto Rico’s indebted authorities, including its public-power company, can’t file for bankruptcy to have their debt restructured in court.

Allison Scott, a spokeswoman for MacKay, said most of the company’s $330.8 million in Puerto Rico bonds are insured. Neither Robert DiMella nor John Loffredo, the co-heads of muni investments, were available for an interview, she said.

Below is a table of the fund companies with the biggest Puerto Rico holdings.

Spokespeople or money managers for the funds declined to comment, with the exception of those cited above.

The figures are based on the most recent company filings to Bloomberg, except for MacKay, which provided more up-to-date data. The tallies exclude derivatives and debt that’s pre-refunded or escrowed to maturity.

Bond values were calculated as position multiplied by market price. Pricing figures are from either Municipal Securities Rulemaking Board trade data or Bloomberg Valuation data, and if neither are available, par or accreted value.

================================================================ Rank Debt Holder Amt (Millions) ================================================================ 1 OPPENHEIMERFUNDS INC. $5,469 2 FRANKLIN RESOURCES INC. $2,275 3 GOLDMAN SACHS GROUP INC. $1,294 4 MACKAY SHIELDS $331 5 LORD ABBETT & CO. $318 6 NUVEEN ASSET MANAGEMENT $314 7 WELLS FARGO & CO. $287 8 CAPITAL GROUP COS. $281 9 EATON VANCE MANAGEMENT $251 10 INVESCO LTD. $248 ================================================================Brian Chappatta

Puerto Rico’s 10 Percent Yields Prove Too Tempting for Goldman to Skip

No comments:

Post a Comment