The Puerto Rico Electric Power Authority, known as Prepa, still needs to come to terms with about two-thirds of creditors, including bond-insurance companies, or the agreement falls apart. An accord that keeps the negotiations out of court expires late Friday. All forbearing creditors except insurer MBIA Inc. are part of that contract, called a forbearance agreement.

“They still have to do quite a bit of work,” said Mikhail Foux, a municipal-debt strategist at Barclays Plc in New York. “They have only about a third of the people on board. We’re talking about monolines and bond funds that effectively bought at par.”

Some bondholders bought Prepa securities for as low as 33 cents on the dollar, giving them room to accept less than par. Bond insurers would have to make investors whole on any deferred payments or potential haircuts, making them less inclined to accept concessions, Foux said.

Forbearance Agreement

A Prepa restructuring would be the biggest ever in the $3.6 trillion municipal-bond market, surpassing Detroit’s record bankruptcy filing in July 2013. The utility, which relies mainly on oil to produce electricity, is the largest U.S. public power provider, with 1.47 million customers and $4.68 billion in electric revenue in 2013, according to the American Public Power Association.The utility has asked creditors to extend the forbearance agreement by two weeks, according to two people with direct knowledge who asked for anonymity because the talks are private. It first signed the pact in August 2014 with bondholders, banks and insurers after the agency used its capital budget to pay for fuel. Its been extended seven times.

Greg Diamond, a spokesman for MBIA, Ashweeta Durani, a spokeswoman for Assured, and Michael Corbally a spokesman at Syncora Guarantee Inc. declined to comment.

Jose Echevarria, a spokesman in San Juan for Prepa, and Jenni Main, chief financial officer at Millstein & Co., an adviser on the utility’s restructuring, declined to comment.

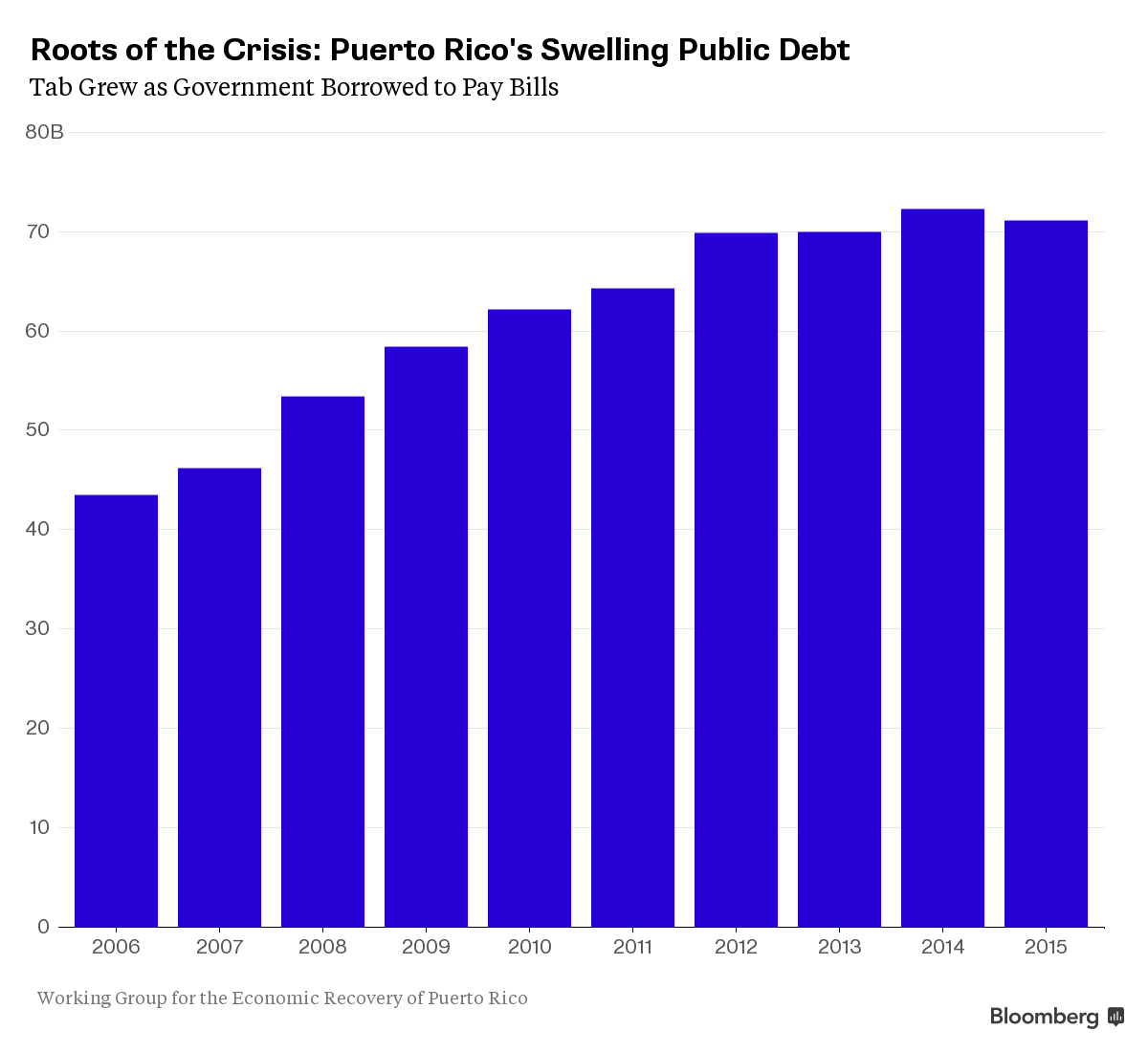

Puerto Rico's Growing Debt Burden

After meeting with Garcia Padilla Thursday, U.S. Treasury Secretary Jacob J. Lew reiterated his support for legislation in Congress that would allow some Puerto Rico public corporations to file for bankruptcy.

“Given the commonwealth’s projection that it will exhaust its liquidity later this year, Congress must act now to provide Puerto Rico with access to a restructuring regime,” Lew said in a statement Thursday. “Without federal legislation, a resolution across Puerto Rico’s financial liabilities would likely be difficult, protracted, and costly.”

Prepa bond prices show the difficulty the utility faces in reaching an agreement with creditors, Foux said.

Bonds maturing July 2040 traded Thursday at an average 60.1 cents on the dollar, according to data compiled by Bloomberg. That’s higher than an average 53.5 cents on Aug. 28, the last time the bonds traded before the Sept. 1 agreement. But that’s still lower than the 85 cents that bondholders would receive in a proposed debt exchange.

Legacy Debt

“One of the reasons they’re trading substantially lower is that there’s still quite a bit of an execution risk,” Foux said.Puerto Rico may ask holders of its general-obligation bonds and sales-tax debt, called Cofina, to take losses, and Prepa could again look to its investors if the proposed debt-exchange fails to improve the utility’s finances, Matt Fabian, a partner at Concord, Massachusetts-based Municipal Market Analytics, wrote in a Sept. 14 report. That plan would swap existing bonds for new securitized debt repaid with a utility-customer surcharge.

“There is reasonably a risk that the commonwealth and/or Prepa would entertain a similar path should Prepa’s restructuring fail to be enough to achieve fiscal solvency,” Fabian said.

Investors who haven’t participated in the forbearance, such as individual bondholders and some municipal-bond funds, would also need to exchange their securities for new bonds, leaving no more than $700 million of legacy debt remaining, according to the agreement.

MBIA’s National Public Finance Guarantee Corp. insures about $1.4 billion of Prepa debt, while Assured Guaranty backs $904 million, according forbearance documents. Syncora Guarantee Inc. insures $197 million.

Those firms must also take into consideration their exposure across all Puerto Rico securities. Assured guarantees $6.2 billion of Puerto Rico debt through 2047, as of June 30. National insures $4.5 billion through 2046, as of June 30.

“If monolines agree to some haircuts here, what would that mean for them with the rest of the bond stack?” Foux said.

Puerto Rico securities have lost 7.2 percent this year through Sept. 17, according to S&P Dow Jones Indices. The broader muni market has gained 0.9 percent.

Michelle Kaske

Puerto Rico Electric at Odds With Insurers on Debt Agreement

No comments:

Post a Comment