The Puerto Rico Electric Power Authority is in talks with investors owning about 35 percent of the agency’s securities and bond insurance companies to free up cash needed to make the principal and interest payments, according to the people, who asked for anonymity because the talks are private. The transaction would be similar to one reached before a Jan. 1 payment, where creditors agreed to buy new securities that mature in 2019. Terms of the July deal are still being worked out, according to two people.

The government-owned utility, called Prepa, reached an agreement in December with hedge funds and mutual funds known as the Ad-Hoc Group and insurers MBIA Inc. and Assured Guaranty Ltd. to restructure $9 billion in debt. The agreement was the first reached between a commonwealth entity and creditors as it seeks to reduce its $70 billion debt burden. The U.S. Supreme Court struck down a Puerto Rico law on Monday that would have let its public utilities restructure their debt over the objection of creditors.

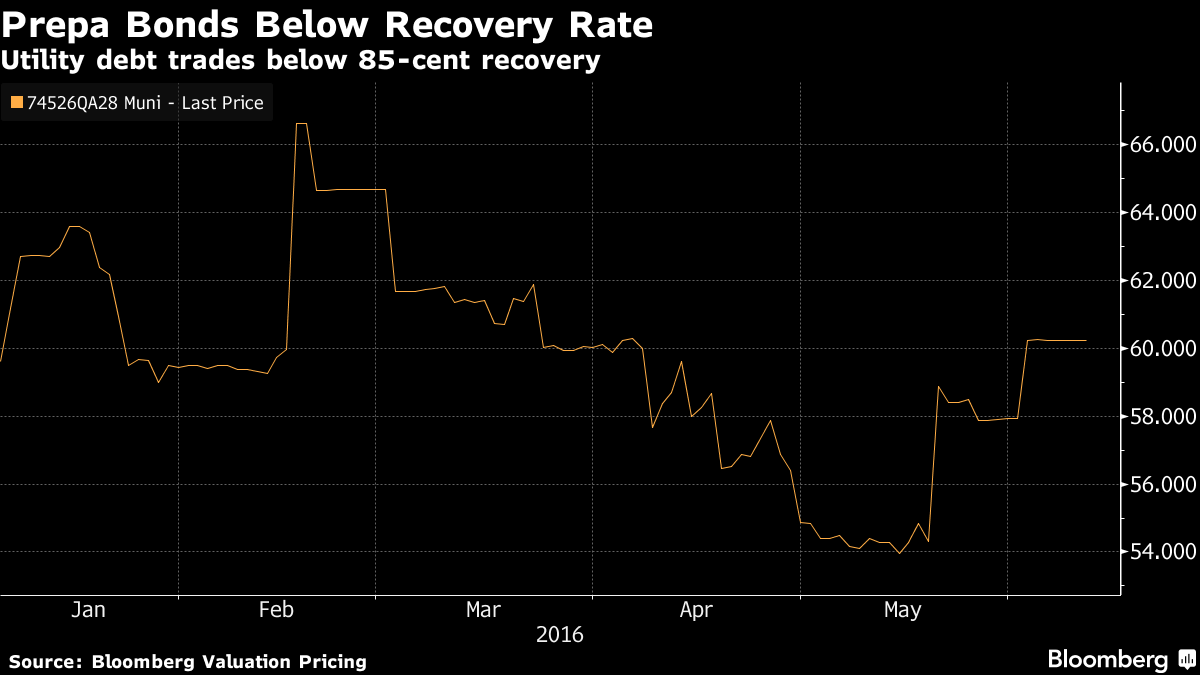

Under the tentative restructuring agreement, bondholders will take a 15 percent loss on their securities for new debt repaid with dedicated revenue that Prepa doesn’t have access to and flows straight to the bond trustee. The island’s energy commission is reviewing a customer surcharge that would repay the restructuring bonds.

Puerto Rico and its agencies, including Prepa, owe $2 billion on July 1. Of that, $805 million is for general-obligation bonds, which Governor Alejandro Garcia Padilla has said the commonwealth cannot pay.

Michelle Kaske

Puerto Rico Utility Said to Offer Plan to Avert July Default

No comments:

Post a Comment