Summary

- Puerto Rico's borrowings represents an exceptionally complex set of credits in the (already arcane-enough) municipal bond market.

- The Legislature's recent rejection of the Governor's tax reform proposal leaves fewer options to balance the budget and raises liquidity concerns.

- This seems like a good time to examine what we think we know about the Island's economy and government finances.

As investors contemplate this situation, perhaps with a sense of panic, it might be worth asking one of Ken Fisher's "only three questions that matter": "What do I think I know that I don't". Following is a list of "facts" about Puerto Rico that have been repeated so often in the media, everyone knows they are true, followed by a little additional information that may help put things in perspective.

1. Puerto Rico's government debt is unsustainably high.

Reality: Puerto Rico's government debt as a percentage of its economy is significantly lower than for the mainland US.By comparison to any state, Puerto Rico's government debt is high. The problem with this comparison is that residents of US states pay most of their taxes to the Federal government, and their government debt burden is also overwhelmingly at the Federal level. In contrast, Puerto Rico residents are exempt from the Federal income tax (they do pay social security and other payroll taxes). The Territory collects most of its residents' taxes, including an income tax that is much closer to Federal rates than to any state income tax rate. Puerto Rico's residents have historically paid $3.5 billion to $4.5 billion per year to the US Treasury compared to about $10.2 billion to the Commonwealth.

So what isthe right measure of Puerto Rico's government debt burden, and how should it be compared to the US mainland? The number for Puerto Rico's government debt that is repeated by every media outlet is "over $70 billion", so let's use that number for now. Puerto Rico's GDP is about $103 billion, so Puerto Rico's total public sector debt is 68% of its GDP. By comparison, Gross Public Debt for the US mainland is 121% of GDP for the average citizen and higher for residents of high debt states.

Many economists argue one should use GNP rather than GDP to measure Puerto Rico's economy. For an explanation of the difference between GDP and GNP and other information about Puerto Rico's economy, see this report by the NY Fed. Puerto Rico's GNP is about $70 billion or under 70% of its GDP; the US's GNP is about 88% of its GDP. Therefore, Puerto Rico's public sector debt is 100% of GNP; and US Gross Public Debt is 138% of GNP.

However, there is a deeper problem with these comparisons: the $70 billion number for government debt is not quite right. Page 56 of the Commonwealth's May 7th financial report details the various categories of public sector debt, and approximately $40 billion is payable from the government's general fund or directly from sales taxes. Using these numbers, Puerto Rico's government debt is 40% of GDP and 57% of GNP.

The other $30 billion of public sector debt includes debt of public corporations, which is not repaid from tax revenues. The two largest of these are the electric utility, Puerto Rico Electric Power Authority (PREPA) and the water utility, Puerto Rico Aqueduct and Sewer Authority (PRASA). If you wanted a fair comparison to government debt on the mainland, you would need to add the total capitalization (debt and equity) of all US water and electric utilities to the government debt numbers. A more detailed discussion of Puerto Rico's electric utility debt is provided under fact number 6, below.

Following is a table summarizing the comparisons of US and Puerto Rico's debt burdens:

Government Debt Burden for Puerto Rico and Mainland US

| Debt to GDP | Debt to GNP | |

| US Mainland | 121% | 138% |

| Puerto Rico Public Sector Debt | 68% | 100% |

| Puerto Rico General Fund and Sales Tax-supported Debt | 40% | 57% |

2. Puerto Rico's citizens are over-taxed.

Reality: The total tax burden of Puerto Rico residents as a percentage of the Island's economy is substantially lower than for the US mainland.Puerto Rico's total tax collections are about $10.2 billion per year, and Puerto Rico residents pay another $3.7 billion to the US Treasury. This total of $14 billion is 13.6% of GDP or 20% of GNP. By comparison, on the mainland, US tax revenues as a percentage of GDP are 33% (38% of GNP). In high-tax states these numbers for the mainland are even higher.

Compared to the rest of the United States, Puerto Rico is a low tax jurisdiction in aggregate. However, many of Puerto Rico's residents may well be over-taxed, specifically, those who comply with tax laws. Puerto Rico has a large underground economy, estimated to be as high as $20 billion. Various studies have estimated that the size of Puerto Rico's "legal" underground economy (excluding illegal activities like drug trafficking) is between 23% and 30% of the total economy compared to 6% to 8% for the US mainland. Moreover, this underground economy grew significantly from 2000 to 2009. The amount of tax revenue lost to the government as a result of this informal economy is estimated to have grown from under $600 million in 2000 to over $700 million in 2009.

In part as a result of the difficulty of collecting taxes from this large underground economy, Puerto Rico is more reliant on corporate and individual income taxes than OECD countries.

Percentage of Government Revenues from Various Taxes

| Tax Category | OECD Countries | Puerto Rico |

| Individual Income Tax | 24.8% | 39.8% |

| Corporate Income Tax | 10.7% | 36.5% |

| Consumption Tax | 31.5% | 23.1% |

3. Investors want to see "Tax Reform" before extending more credit to the Commonwealth.

Reality: Investors just want to see a credible balanced budget based on recurring revenues and expenditures. They care much less how that is achieved.The Governor's tax reform proposal was one of several ways to balance a budget. The Administration was seeking to deal with the problem of very high non-compliance with sales and income taxes in an economy with a high level of cash transactions. The House's rejection of the Administration's tax proposal leaves fewer options, but in some ways these options are more predictable. A new tax system would have introduced the risk that collections might be lower than anticipated. By contrast a one cent increase in the current sales tax can reliably produce a $250 million increase in annual general fund revenue.

4. Anyone with the resources to do so is emigrating, leaving behind a poorer, less educated population.

Reality: Those recently leaving Puerto Rico are less educated and poorer than those who are choosing to remain on the Island.This article would have us believe that Puerto Rico's economic challenges combined with its new law exempting new residents from taxes on investment income is driving out the educated "young professional" and other members of the middle class and replacing them with millionaires. The reality is not as sensational.

According to a study by the Pew Research Center:

"Although more recent Puerto Rican migrants to the mainland are better educated than earlier waves, more recent migrants in the prime working ages (30-64 in 2011) are less educated than people who remain on the island, according to other research (Mora, Davila and Rodriguez, 2014). A Pew Research analysis of census data indicates that Puerto Ricans on the island are more likely than island-born Puerto Ricans living stateside to have at least a bachelor's degree (24% versus 15% in 2012). A lower share did not finish high school (27% to 32%).

"Recent migrants, especially men, compared with earlier migrants, also are more likely to hold blue-collar jobs in low-skilled industries such as construction, maintenance and agriculture, and less likely to hold professional jobs (Birson, 2014). On the island, the earnings payoff for those holding college degrees rose more from 2006 to 2011 than for those on the mainland, which means that less-skilled workers had more incentive than high-skilled ones to migrate (Mora, Davila and Rodriguez, 2014)."

5. Puerto Rico's private economy cannot produce jobs for its citizens.

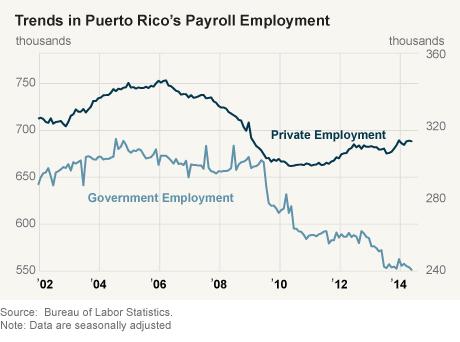

Reality: Puerto Rico has historically been highly reliant on government employment, and the current fiscal challenges are causing severe losses in government employment, but private sector employment is growing.

Puerto Rico's economy is going through a painful transformation that will likely leave it less reliant on government intervention.

6. Puerto Rico's high electricity prices are a result of mismanagement and an over-indebted utility.

Reality: Puerto Rico's electric rates are lower than Hawaii's and the US Virgin Islands, and the utility's debt is similar to other governmentally-owned utilities.Investor-owned utilities, such as Duke, Southern Company, Con Ed, Hawaiian Electric, fund capital with a combination of debt and equity (generally in a ratio of about 50/50). Government-owned utilities, such as Tennessee Valley Authority, Los Angeles Department of Water and Power, the New York Power Authority, Municipal Electric Authority of Georgia generally rely on debt and retained earnings to fund capital expenditures. Public power entities therefore always look more leveraged than their for-profit counterparts. However, since they do not have to generate equity returns to stockholders, the higher relative amount of debt they carry does not necessarily translate to higher electric rates, and may actually result in lower rates, since equity returns allowed by regulators are generally high (generally around 10%) compared to borrowing costs.

PREPA's power rates are high for several reasons:

As an island utility without an indigenous source of fossil fuel, PREPA has to import its fuel sources, and oil is easier to ship than coal or natural gas. PREPA's reliance on oil looks ridiculous until one considers the transportation costs of the fossil fuel alternatives.

The Jones Act requires shipments from the US mainland to Puerto Rico be carried on US-made vessels, which makes mainland-to-Puerto Rico shipping much more expensive than shipments from (say) Brazil. Consequently, it's not clear how much Puerto Rico could benefit from cheaper US natural gas, even if liquefaction were up and running in the US.

The Puerto Rico legislature has imposed a series of expensive mandates on PREPA, most notably a requirement that PREPA pay "Contributions in Lieu of Taxes" or CILTs to municipalities amounting to about $200 million per year and special subsidies to various industries. The CILTs are expressly subordinated to bond debt service, so in the event of a revenue shortfall, the CILTs should be curtailed or deferred before PREPA's bondholders are affected. However, in practice, PREPA has allowed the municipalities to offset their power bills by the amount of CILTs owed to them, which effectively puts CILTs ahead of bondholders in the cash flow "waterfall". What PREPA, should do (and what a court may well require PREPA to do) is defer payments to municipalities in favor of bondholders. Municipalities could presumably refuse to pay their electric bills, and a privately-owned utility would presumably respond by cutting off power. You can see why the current Administration would rather not to go there and may prefer to have a court decide the issue.

In any case, it is useful to put statements like "Puerto Rico's electric rates are crippling the economy" in context. The table below provides some interesting comparisons.

| Average Retail Price of Electricity to Customers by Sector, | ||||

| 2015 for States, 2013 for PR and 2012 for USVI (Cents/kWh) | ||||

| Residential | Commercial | Industrial | All Sectors | |

| Connecticut | 21.00 | 16.79 | 13.20 | 18.44 |

| Massachusetts | 20.80 | 16.53 | 13.16 | 17.87 |

| New Hampshire | 19.15 | 15.75 | 12.83 | 16.87 |

| New York | 19.29 | 14.62 | 6.09 | 15.36 |

| Alaska | 19.35 | 17.26 | 14.44 | 17.51 |

| Hawaii | 33.34 | 31.07 | 26.68 | 30.04 |

| US Virgin Island | NA | NA | NA | 33.51 |

| Puerto Rico | 25.05 | 27.93 | 26.19 | 26.84 |

| U.S. States | 12.10 | 10.30 | 6.62 | 10.19 |

So compare this disastrously over-leveraged, poorly-run utility to the Southern Company, an entity most investors would cite as financially conservative and well-managed. According to its most recent 10-K, Southern Company paid out approximately $4.3 billion in its last fiscal year for interest, dividends, debt retirement and share buybacks, which amounts to 23% of its $18.5 billion in revenues.

For an entity involved in something as capital intensive as the generation and distribution of electricity to pay less than 15% of its total revenues to its investors for return of and on their capital seems like an exceptionally good deal. To impose a (say) 50% loss on those investors in order to reduce its power rates by 7%, seems foolish, given the long term impact that move is likely to have on its future access to and cost of capital.

PREPA's historic reliance on oil, rather than coal or natural gas is more understandable when transportation costs and capital expenditures associated with conversion to other fossil fuels are considered, and it is possible that the best near term response to lower oil prices is to defer conversion to natural gas. For a more detailed discussion of the effect of lower oil prices on Puerto Rico's economy and PREPA see this article.

7. A restructuring of Puerto Rico's government debt is inevitable.

Puerto Rico's fiscal challenges are well within the capacity of the Island's economy to address.Puerto Rico's economy is not particularly overburdened with government debt or excessive taxation. The increase in debt in recent years is a symptom, not a cause, of Puerto Rico's economic challenges.

Puerto Rico's industrial economy benefited for many years from an arcane set of subsidies in the US corporate tax code, including the Section 936 tax credit for certain corporations that located facilities on the Island. The elimination of these subsidies had a predictably negative impact on the economy, and the government was slow to adjust to the decline in economic activity, relying on deficit financing and hoping for a turnaround. The current administration has made major strides in dealing with the fiscal challenges of achieving a balanced budget, and the deficit has been steadily reduced. Governments often resemble slow, lumbering beasts, but they can sometimes move quickly in a crisis. The current financial crisis might be a catalyst for important reforms.

8. Puerto Rico needs a "road map" to resolve creditors' claims in the event of an default.

Reality: The US Constitution, Puerto Rico's constitution, the statutes authorizing government borrowing and the bond indentures that constitute valid, binding and constitutionally-protected contracts between borrowers and investors provide very clear and detailed road maps in the event of default for every single one of Puerto Rico's government borrowers.

To explain its decision to pass its own bankruptcy law, Puerto Rico claimed that it needed to have the same access to Chapter 9 that every other state currently has to provide a "road map" for its governmental borrowers in the event of a default. In fact, from a creditor's point of view, the Commonwealth's law was much more draconian than Chapter 9. For example, Chapter 9 generally protects bonds secured by a revenue pledge from a "stay", which allows the borrower to stop paying debt service. In contrast, Puerto Rico's law could potentially allow a borrower to suspend payments from revenues pledged to pay debt service.

The passage of this law eroded the Commonwealth's credibility with bond investors and has almost certainly contributed to its lack of access to the capital markets. The Puerto Rico Federal District court set the law aside, agreeing with creditors that only Congress has the right to pass bankruptcy laws, and Puerto Rico is appealing this decision.

Puerto Rico is also lobbying Congress to amend Chapter 9 to allow the Commonwealth to permit its subdivisions to file for bankruptcy protection, arguing that it needs this right afforded to US states. Now, I happen to believe that as a matter of fairness, Congress should amend Chapter 9 to treat US Territories as states. However, under Chapter 9 many governmental entities cannot file for bankruptcy protection. States do not have the right to file Chapter 9, and many states do not permit their subdivisions to file Chapter 9. Many governmental borrowers, over a long period of time, have resolved their fiscal challenges without resorting to bankruptcy protection. New York City, Cleveland, Bridgeport and host of other US cities, have turned around their finances without requiring bond holders to take a loss.

In any case, the media tends to ignore an important detail about all of these issues: neither the Commonwealth's bankruptcy law, nor Chapter 9 would apply to the Commonwealth's obligations. These laws would only apply to subdivisions, and the Administration seems to be focused on using them only for PREPA, PRASA and the Highway Authority.

Whether or not it is possible or advisable to use bankruptcy laws to impose a loss on bondholders, it is not quite accurate that there is no other road map.

Every bond indenture includes a detailed set of covenants by the borrower and a set of remedies available to bondholders in an event of default. For example, PREPA's most recent offering document contains the following promise:

"The Authority has covenanted in the Trust Agreement to fix, charge and collect reasonable rates and charges so that Revenues of the System will be sufficient to pay Current Expenses and to provide an amount at least equal to 120% of the aggregate Principal and Interest Requirements for the next fiscal year on account of all outstanding Power Revenue Bonds..."Of course, PREPA's and the Administration's desire not to raise electric rates is understandable, but the long term cost to Puerto Rico's tax payers and rate payers may be much higher if PREPA defaults on its obligations than if the utility follows the road map laid out by existing laws and contracts. In any case, there are courts of competent jurisdiction available to interpret constitutional, statutory and contractual language without applying Chapter 9.

Conclusion

Puerto Rico has been compared to Greece, but this is an uniformed comparison. Comments (here and here) by Charles Blizter, a former IMF official and World Bank economist, provide more useful comparisons, including the following:

"Puerto Rico's debt situation is nowhere near as dire as generally believed. Puerto Rico is an economy of $100 billion GDP. And of the $70 billion of debt, a big chunk of that is not guaranteed by the taxpayers but is debt from government-owned corporations like PREPA. So 42 percent is tax-supported debt. Compared to emerging markets and below investment-grade companies, that's a low level of debt. Countries like Hungary have 80 percent, Serbia has 67 percent, Greece has 170 percent. And in Puerto Rico, because of the muni tax breaks, coupons are low and maturities are long. They don't have an underlying debt sustainability problem. They have a liquidity problem and a problem restoring market confidence and being able to access the markets at a reasonable rate. So they are in much better shape from a debt sustainability point of view than may be obvious.Puerto Rico has serious fiscal challenges, and the perception that they cannot be addressed can become a self-fulfilling prophecy (Perception is reality? Perhaps at least in the short term.) However, most investors will benefit from looking carefully at the long term underlying reality.

"In terms of fiscal load, Puerto Rico is much more like a BB-rated country. I've never seen a country with this load of debt actually default. It's clear the Puerto Rico government needs to take a few steps to fix the situation. They need to be clear on exactly what the fiscal situation is and present data and projections about the fiscal situation in a way that's consistent to what investors around the world are used to seeing. They need to present an understandable view of what things are and how they are going to close the deficit. Puerto Rico doesn't need to go through the type of adjustment that Greece needs to go through." (emphasis added)

Additional disclosure: The author is long bonds of the Commonwealth of Puerto Rico and various agencies and subdivisions

Eight Things We Think We Know About Puerto Rico

No comments:

Post a Comment