The highway agency purchased debt insured by MBIA’s National Public Finance Guarantee Corp. and canceled it on Nov. 13, according to a report on the company’s website that was updated Monday. The authority did the same thing with $228.5 million of bonds backed by Ambac Assurance Corp., that company confirmed last week.

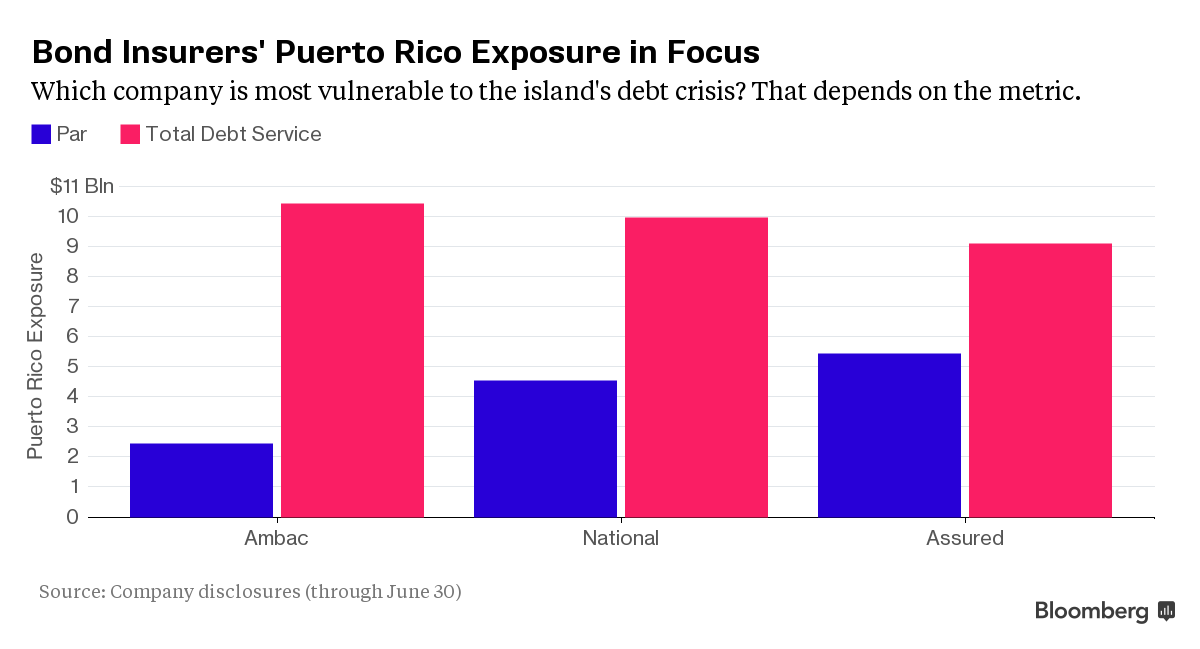

That eases some of the losses the insurers face from a building fiscal crisis that’s left the commonwealth struggling to pay its $70 billion of debt. Puerto Rico, which is rapidly draining its cash, has $467 million of principal and interest due Dec. 1 and $958 million owed on debt including general obligations on Jan. 1.

That has made the chief executive officer of rival insurer Assured Guaranty Ltd. focused on the transportation authority, according to Mark Palmer at BTIG LLC, a brokerage firm.

At a bond-insurance panel that BTIG hosted Monday, Assured CEO Dominic Frederico indicated “the potential for the government to take irrational actions with regard to the debt made it a priority,” Palmer wrote Tuesday in a report. “While the Puerto Rico government would not be able to claw back revenue from tolls, its ability to do so from other revenues had made management concerned.”

MBIA Puerto Rico Highway Agency Risk Falls as Bond Payments Loom

No comments:

Post a Comment