Prices of Puerto Rico bonds suggest that investors are circumspect when its comes to possible progress in a debt exchange of the island’s securities and focusing on whether the commonwealth makes good on $711 million of principal and interest payments coming due.

“They’re waiting to see what the commonwealth does from here,” said Daniel Hanson, an analyst at Height Securities, a Washington-based broker dealer. “They really want Puerto Rico to show some good will by paying bonds over the next six weeks.”

Commonwealth general obligations maturing July 2035, the most-actively traded uninsured Puerto Rico bond in the past three months by volume, changed hands Monday at an average of 71.3 cents on the dollar, compared with 71.7 cents on Friday, data compiled by Bloomberg show. The bonds yield about 11.8 percent on average.

The Caribbean island and advisers to bondholders and hedge funds that invest in Puerto Rico securities met in New York last week. Advisers for the commonwealth gave some details of a potential universal debt-exchange where investors holding Puerto Rico bonds with different repayment pledges trade in their debt for a single new bond with stronger securities.

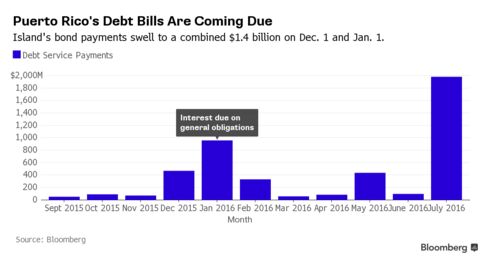

Timely bond payments on Dec. 1 and Jan. 1 may boost debt prices, offering a way for investors to reduce their Puerto Rico exposure, Matt Fabian, a partner at Concord, Massachusetts-based Municipal Market Analytics, wrote in a report Monday.

“Bond prices would reasonably rally, providing what could be the most attractive exit point for investors before defaults and/or restructuring in 2016,” Fabian wrote.

Investors are choosing to hold their existing securities to see if Puerto Rico’s Government Development Bank will pay $354 million due Dec. 1, with $267 million of that guaranteed by the commonwealth. An additional $357 million of general-obligation interest is due Jan. 1.

Puerto Rico and its agencies owe $70 billion. Officials are seeking to reduce that debt load by delaying principal payments or asking investors to take a loss in a debt exchange. The island’s economy has failed to grow since 2006.

Hanson cited competing claims, no exit strategy for hedge funds, local law and lack of consensus on workout as reasons for investors to be wary. Last week’s meeting involved investors holding about 15 percent of the island’s debt, Hanson estimated.

Puerto Rico Bond Payment Overshadows Debt Exchange Optimism

No comments:

Post a Comment